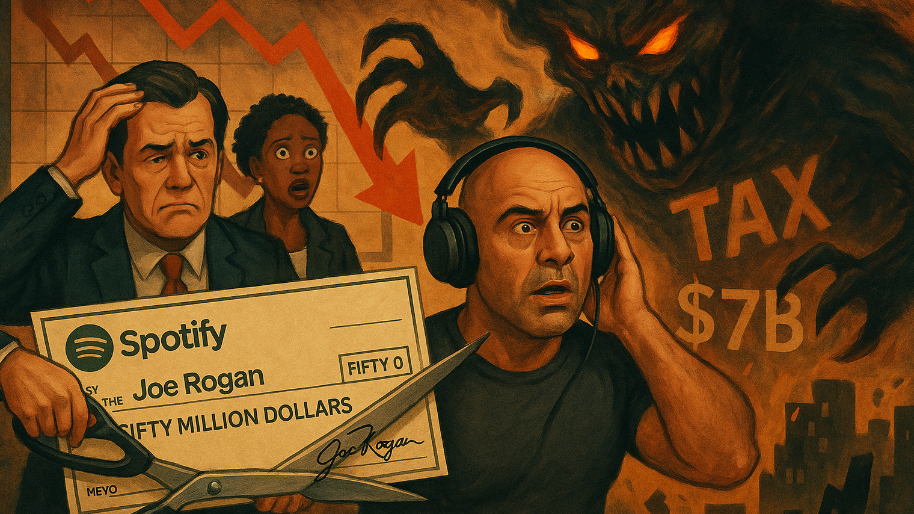

Over the last couple of years, Spotify executives have made a point to start looking at the numbers and using logic (losing money from 2006-2023 and never posting a full-year net profit will do that to you). After wiring $200 million to Joe Rogan so he could talk about elk meat and ayahuasca for three hours straight, and tossing $60 million at Call Her Daddy to dissect hookup strategy like it’s foreign policy… someone in the C-suite finally said, “Wait… are we actually making money from this?” (they definitely weren’t).

So Spotify did what any maturing, cash-burning tech company eventually has to do when investor patience runs thin… they got disciplined. The company shifted away from high-cost, exclusive podcast contracts and ran towards non-exclusive licensing agreements. The reason for the change was simple: they still want big-name creators like Joe Rogan and Alex Cooper on the platform, but they’re no longer willing to pay Netflix-level premiums to lock them in.

(Source: Variety)

In addition to the “better late than never” podcast detox… Spotify decided to trim fat across the board. They laid off 25% of their workforce (2,300 employees), raised subscription prices in dozens of markets, and cut marketing and content acquisition budgets that had exploded (in a bad way) during its “growth at all costs” era. And shockingly… It worked. By the end of 2024, Spotify posted its first full year of profitability and Wall Street awarded the company a 138% gain.

So heading into Q2 2025, expectations were baked into the stock price and frosted with investor optimism. Analysts were projecting $2.15 in earnings per share. Not because they were feeling lucky, but because Q1 had crushed it… Spotify added millions of users, expanded margins, and printed $570 million in free cash flow. But then… the earnings report dropped. And it landed like a fart in church.

Instead of posting another strong quarter, Spotify swung to a $100 million net loss. And just like that the stock instantly tanked 10%, erasing nearly $7 billion in market value (at the time of this writing).

So what went wrong? I actually think it will be easier if we start with what didn’t. Spotify’s user growth is still firing on all cylinders. They added 8 million new premium subscribers, hitting 276 million total, while monthly active users climbed to 696 million… both ahead of expectations. On top of that, for Q3, they’re projecting 710 million. So clearly, people aren’t fleeing the platform (ironically, the more annoying your ads become, the more users who are willing to pay for premium).

Revenue was solid at $4.75 billion, up 10% year-over-year, which (under normal circumstances) would’ve been a win. But analysts were looking for $4.84 billion, and as we all know, even tiny misses like that get treated like a felony on Wall Street… especially when they come bundled with other disappointments.

So what was the real issue this quarter? Well, while revenue came in light, the real damage came from the cost side of the equation. Spotify’s operating expenses jumped 8%, totaling $1.06 billion, and a big chunk of that came from something called “social charges.” Now, if you’re unfamiliar with that delightful little European invention, it’s essentially a payroll tax tied to stock-based compensation. Even worse: it gets more expensive as your stock price goes up. So when Spotify’s shares hit an all-time high of $785 earlier this quarter, it triggered a surprise tax bill tied to all that employee equity.

In other words, the company quite literally got punished for doing too well in the market. (Yes, really. Try explaining that one with a straight face on an earnings call.) But that wasn’t the only leak. The company also spent more on marketing, personnel, and probably a few too many consultants charging $900/hour to tell them to "lean into AI-driven engagement ecosystems."

And then there's advertising… the so-called “next leg of growth.” But whoopsies… Spotify’s ad-supported revenue actually fell 1%. Which, for a platform with nearly 700 million users, is like owning a $200,000 G-Wagon and using it to deliver DoorDash (just doesn’t make a lick of sense). CEO Daniel Ek blamed it on “execution challenges” (aka “we’re not totally sure what went wrong, but let’s not panic… yet.”)

To make matters worse, guidance for Q3 was weak. Spotify expects revenue of $4.86 billion, while analysts were banking on $5.25 billion. So to summarize… Spotify did the hard stuff. It laid off a quarter of its workforce, raised prices, killed off its toxic relationship with exclusive podcast deals, and even got a taste of profitability. But Q2 was a reminder that making money once doesn’t mean you get to do it forever… especially when your stock price triggers surprise tax bills and your ad business is stuck in neutral.

Spotify’s still growing. But if it wants to keep its newly earned “profitable tech company” badge, it’s going to have to start turning that massive user base into consistent, high-margin cash flow. Otherwise? It’s back to being the company that made “growth” cool… and “profits” optional.

At the time of publishing this article, Stocks.News holds positions in Spotify and Netflix as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer