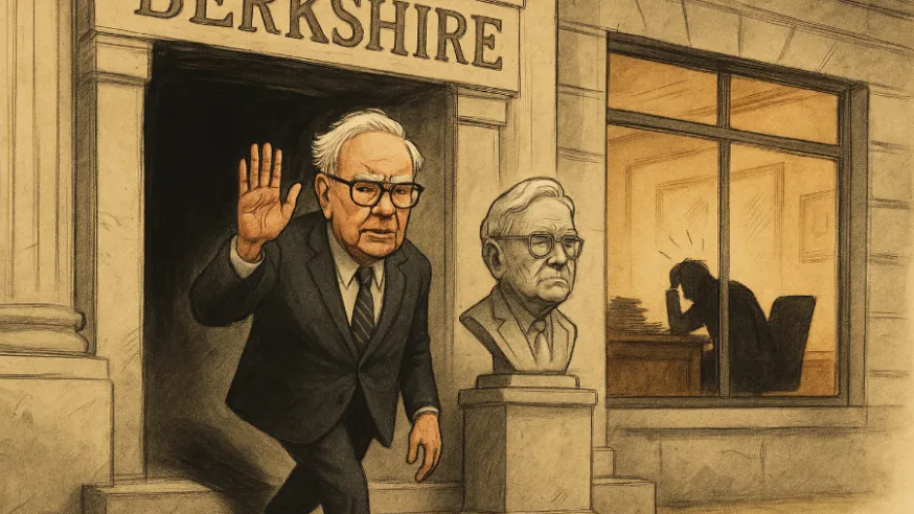

There are things in life you assume are permanent: Death, taxes, and Warren Buffett sitting in that same damn chair at Berkshire HQ forever. Well… scratch one off that list.

In a moment that felt like watching Mr. Rogers light a cigarette and walk off set mid-song, Warren Buffett (the Warren Buffett, aka the Oracle of Omaha, the Financial Yoda, the GOAT of compound interest) has officially announced he’s stepping down as CEO of Berkshire Hathaway at the end of the year. Let me say it again for the people still emotionally rebalancing their portfolios… Warren. Is. Stepping. Down.

After six decades running one of the most legendary investment machines in history (a $1.16 trillion empire with 189 operating businesses, $264 billion in stocks, and $348 billion in cash sitting on the sidelines) Buffett has decided it’s time to pass the torch. Or, more accurately, gently set it down next to Greg Abel with a wink and a handshake.

If you’re not familiar with Greg Abel, don’t worry… most people weren’t until the start of last week leading up to the big Berkshire Hathaway shareholder’s meeting (they primed the media with some backstory articles just to prepare us). He’s been quietly running Berkshire’s non-insurance operations since 2018 and has been with the firm for over 25 years.

Abel was officially voted in as the next CEO by Berkshire’s board (unanimously) and will take over January 1, 2026. That surprise twist is that Abel himself didn’t even know Buffett was going to make the announcement at the annual shareholder meeting. Which means Buffett not only YOLO’d $348 billion into cash and T-bills this year… he also YOLO’d the CEO transition.

Before you start panic-selling your Class B shares (which were down 2% in premarket), here’s the part that’s keeping the market from jumping off a cliff: Buffett isn’t fully disappearing. He’s staying on as chairman and said he’ll be around to help if “periods of great opportunity” show up (aka a market crash). Greg’s driving the car, but Warren’s still in the front seat with Google Maps open… and of course, a Diet Coke in hand.

What Abel does with Berkshire’s mountain of cash is the big question. For the first time in 20 years, Berkshire owns more cash than equities. At $348 billion, Berkshire is holding more Treasury bills than some countries. Seriously… if Buffett was a sovereign state, he’d be the 10th-largest holder of U.S. government debt.

On top of that, Buffett’s been aggressively trimming stock positions lately… including a notable slice of Apple. Because, as he puts it, there’s nothing out there worth buying right now (aka valuations are hot garbage). Abel’s challenge will be to either keep sitting on that record pile of cash… or find some juicy, undervalued companies that won’t make Buffett come back from his vacation in the Bahamas.

Some are wondering if Berkshire under Abel might get more aggressive internationally… especially with 80% of cheap, under-PE-10 companies living outside the U.S. But knowing Buffett’s loyal fanbase and aversion to hype-driven investing, it’s more likely Abel plays it cool for a while.

For most of us, this is an emotional shift more than a strategic one. Buffett is Berkshire. Always has been. Watching him step aside feels like watching Michael Jordan hand over the ball… mid-game. But the empire he built is still standing. Strong. Maybe stronger than ever.

And if Greg Abel’s been Warren’s pick for years (if Warren freaking Buffett trusts him) maybe we should, too.

PS: It’s a mess out there.

One day the market’s ripping, the next day it’s Black Monday all over again. Recent earning’s reports have been a total coin flip. One stock beats and explodes 30%… the next misses by a penny and gets sent to the Shadow Realm. And through it all, everyone’s begging for Jerome Powell to finally cave and cut rates.

But underneath all the panic headlines (“Inflation too sticky!” “Recession imminent!” “Tariffs round 4 incoming!”) something wild is happening…

We’re seeing violent price action. Especially in the small-cap space, where low floats and high anxiety are creating the perfect recipe for 100%+ pops before lunchtime. Some of these names are moving 200%+ in under 24 hours… and to our knowledge, NO ONE else is covering them.

Except us.

Stocks.News Premium members are getting first dibs on these stealth explosions… thanks to our squeeze signal scanner and real-time insider trading tracker that zeroes in on the money before the momentum shows up.

If you’ve been whiplashed by this market or feel like your strategy is stuck in 2022, it’s time to flip the script.

Premium gets you:

- Two breaking trade alerts per week

- Access to the same scanners we use to track CEO buys and Capitol Hill moves

- Our custom market sentiment tool (that actually works)

- Premium stock writeups packed with actual analysis (that’s not boring)

Go here to become a Stocks.News Premium member now.

Stock.News has positions in Google, Coca-Cola, and Apple.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer