After five decades of building the most powerful hedge fund on the planet (and let’s not forget, reminding us every few years that society was about 15 minutes away from collapsing), Ray Dalio has officially peaced out of Bridgewater Associates.

As of today, Dalio has sold off his remaining stake in the firm and stepped down from the board, marking the end of his formal involvement with the company he started in 1975 from a tiny New York apartment. What began as a humble investment newsletter operation morphed into a $150+ billion monster of global macro investing.

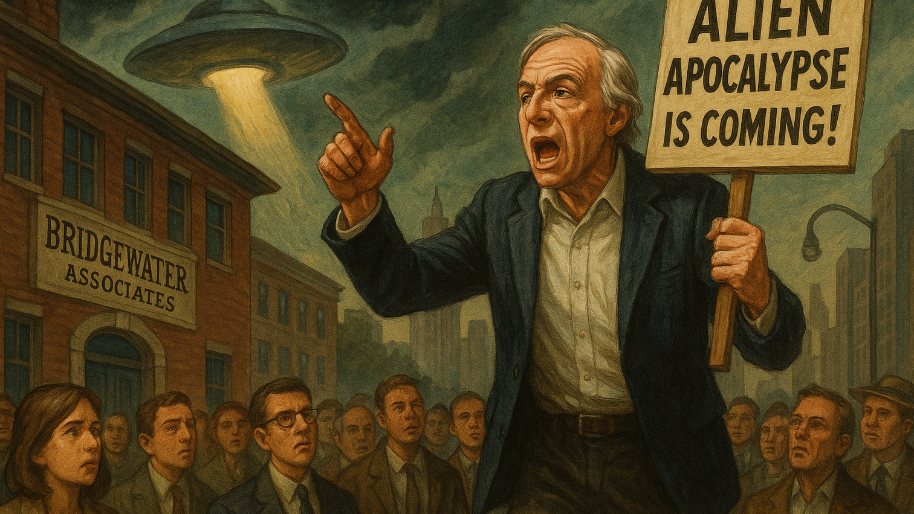

But while Bridgewater got famous for its performance (and its culty internal rating systems), Dalio became just as known for something else entirely: shouting “The End Is Near!” like a doomsday preacher with full access to a Bloomberg terminal. Economic collapse? Oh yeah. Civil war? You bet your bottom dollar. Global realignment, spiritual decay, a fall of the U.S. dollar, maybe a plague of locusts? Ray had a blog post queued up for all of it.

He kicked things off with humble beginnings… running Bridgewater out of his apartment, armed with nothing but a typewriter, an obsession with global economics, and a burning desire to explain the bond yield curve to anyone who would listen. One of his first big clients was McDonald’s. Yes, seriously. He helped them hedge against chicken price volatility so they could launch the McNugget. (A contribution to humanity arguably more important than anything he’s done since.)

By the mid-2000s, Bridgewater had transformed from boutique research nerd zone into a global empire managing tens of billions for central banks, oil-rich kingdoms, and anyone else with a large checkbook and existential fear of inflation. By 2019, it had ballooned to $160 billion in assets, officially taking the crown as the world’s largest hedge fund.

(Source: Business Insider)

And at the same time… Dalio morphed into finance’s resident philosopher king. He was releasing bestsellers, giving TED Talks, and dropping viral LinkedIn manifestos about why democracy might not survive the decade. (Which, by the way, usually ended with some variation of “buy gold” and then later bitcoin.) Through it all, one thing never changed: Ray Dalio was constantly warning us that the end was near. You could practically set your Apple Watch to it.. every couple of years, Dalio would pop up with another economic doomsday prediction. In 2011, he warned the U.S. was heading into a “lost decade” like Japan. The S&P 500 then proceeded to quadruple.

In 2016, he said rising populism was a “recipe for conflict” and compared the climate to the 1930s. Naturally, the markets ripped for years. Then came 2018, when he predicted a “paradigm shift” that would crush equities. The Nasdaq jumped 80% in two years. During peak COVID panic in 2020, he famously declared “cash is trash”... right before growth stocks and bonds skyrocketed (then crashed, but still). By 2022 and 2023, he was writing about a “changing world order” and warned that the U.S. could descend into civil war. And in 2024, he told everyone to brace for a “debt-driven collapse”... just as the market hit fresh all-time highs.

(Source: Economic Times)

Look, to be fair, the guy’s not completely off base. Debt, inflation, and geopolitical risks are real. But after a while, it started to feel like every time the wind changed direction, Dalio was banging out another 10,000-word think piece titled something like “Why Everything Might Fall Apart This Time (No Really, I Mean It)”.

As for his actual goodbye? It’s been more of a decade-long Irish exit. He stepped down as CEO in 2017, left the chairman role in 2021, handed over control in 2022, and finally, yesterday, sold his last chunk of equity and exited the board. So yeah, it only took eight years for the world’s most dramatic macro manager to finally hand over the keys. (Now go play some golf and enjoy the beach with the grandkids Ray, you deserve it).

(Source: Fortune)

Bridgewater is now officially a Dalio-free zone… for the first time since all our parents were lining up to see Jaws and thought inflation was just something that happened to balloons. But his fingerprints are still everywhere. The infamous “radical transparency” culture where meetings were filmed and coworkers rated each other like Olympic judges. That’s pure Dalio. So is the All Weather portfolio (designed to survive anything short of asteroid impact), and the endless obsession with macro trends that turned global GDP data into bedtime reading for an entire generation of portfolio managers.

And in case you were wondering who’s steering the ship now… Nir Bar Dea is the CEO, Bob Prince and Greg Jensen are running investments, and the Brunei Investment Agency just bought up nearly 20% of the firm. (Makes sense… when you sell a legendary hedge fund, you obviously sell it to a royal family with oil money. Who else?)

But just because Dalio’s out of the boardroom doesn’t mean he’s gone quiet. He’s still out there… writing essays, giving interviews, and probably pacing around his Connecticut mansion connecting the collapse of the Roman Empire to NVIDIA’s forward P/E ratio. Most recently, he suggested investors put 15% of their portfolios into Bitcoin and gold… up from his earlier 2%. So yes, even in retirement, Doomsday Dalio is still in full prepper mode. He’s just diversified the bunker a little.

Say what you will, but the man built something legendary. He turned a typewriter and a theory into the biggest hedge fund on earth. He changed how Wall Street talks about cycles, risk, and economic collapse. And he made a very profitable career out of scaring the heck out of rich people. (Respect.)

And now, with the firm in new hands and his prophecy megaphone still fully charged, Ray Dalio is officially out. But don’t worry… he’ll be back soon to tell us why this time, the financial ice age is definitely coming (by the end of 2026).

At the time of publishing this article, Stocks.News holds positions in McDonald’s and Apple as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer