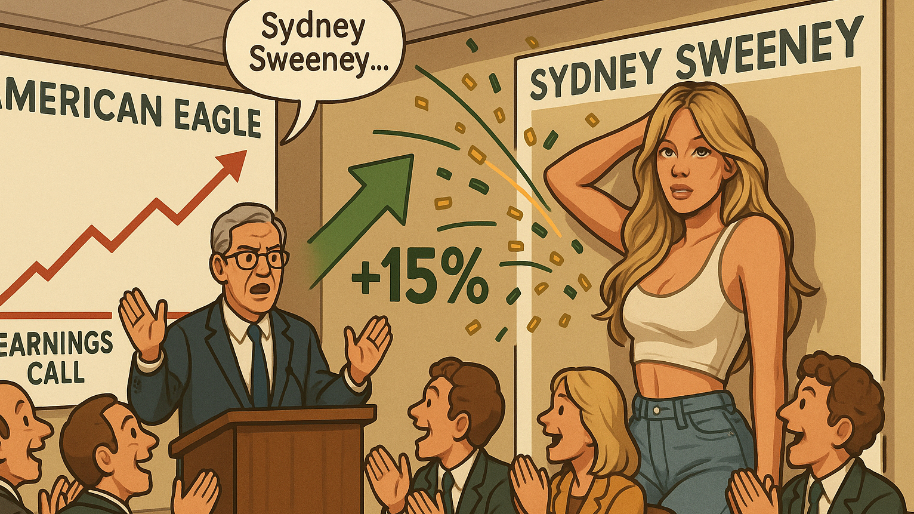

If I had to guess… American Eagle’s top brass hopped on their earnings call, sighed dramatically, closed their binders, and declared, “Our corporate strategy from here on out? Sydney Freaking Sweeney.” And with shares launching 15% after hours, it’s obvious investors responded with a resounding, “Godspeed, kings.”

In their defense, it’s clearly the right move. The retailer reported third-quarter numbers that blew away every single analyst that dared to cover the stock. No matter what you think about Sydney and the entire internet acting like she’s the only female on earth… the numbers don’t lie. Revenue beat expectations by 3% and EPS was a whole 20% above what was penciled in.

The irony is that while the company is bragging about its splashy celebrity campaigns, this quarter wasn’t even the real payoff. Sweeney’s viral jean ads (the ones that had Instagram moms writing think-pieces and teenage boys running to the bathroom during class to look at the new AE ad that just dropped) didn’t launch until the final week of fiscal Q2.

(Source: Financial Times)

On top of that, Taylor Swift’s fiance's new collection pretty much arrived yesterday. And yet here we are, watching American Eagle lift its full-year operating income forecast all the way up to $308 million, well above the previous $265 million ceiling. And somehow they’re thriving in a landscape where most mall retailers are either vanishing into bankruptcy or being reincarnated as Spirit Halloween the second management forgets to lock the doors.

Companywide comparable sales were up 4%, beating the 2.7% the suits expected. But the real A+ student was Aerie, again, posting an 11% comp increase and a 13% revenue jump. Meanwhile, the American Eagle banner (the brand actually plastered with Sydney and Kelce’s faces) pulled off a barely-there 1% comp gain, which was somehow still worse than what analysts predicted. Translation: the campaigns are working, but the cash register hasn’t fully caught up to the thirst traps yet.

(Source: Forbes)

Then came the part of the earnings call where investors started clapping like seals… American Eagle’s holiday forecast is straight swagger. Management says comps are going up 8% to 9% in Q4, and that they expect comparable sales in Q4 to jump 8% to 9%... quadruple what analysts thought. They even announced that Thanksgiving weekend was supposedly “record-breaking” (which to be fair that is Black Friday, but good news is good news).

This is also an insane plot twist when you remember American Eagle has spent the last couple of years teaching a Masterclass called “How to Disappoint Shareholders 101.”

They botched their inventory so spectacularly they had to write down $200+ million (plus enough leftover product to clothe the entire population of Canada) then baffled everyone by moonwalking away from their big body-positivity push. And, of course, they’re a mall retailer… a species that Amazon is trying to make extinct.

But now the turnaround is in full force. Momentum is up, traffic is up, and CEO Jay Schottenstein is out here sounding like he just unlocked the speedrun for retail resurrection. And with record revenue this quarter and a holiday forecast that looks like it was written by Santa’s accountant, it’s clear the Sweeney/Kelce duo is about to hit the numbers in Q4 the way Kelce used to hit a soft zone coverage.

(Source: Medium)

But in my opinion, the real winner here is Sydney Sweeney, who at this point might as well hang up the acting career and become a full-time influencer. The algorithm clearly loves her more than any casting director ever could.

At the time of publishing this article, Stocks.News holds positions in Amazon as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer