The other day, I was working out and listening to YouTube when I stumbled on a Dave Chappelle SNL skit that had me laughing so hard I nearly dropped my weights. Then it hit me… what’s funnier than a Dave Chappelle stand-up routine? Then I saw Boeing’s new financial statements. Seriously, if their earnings calls don’t make you laugh, it’s only because you own the stock.

And this morning’s update? Oh, it delivered. Boeing reported a commendable $11.83 billion annual loss… their biggest catastrophe since 2020. Turns out, when your planes are grounded, your defense contracts are crashing and burning, and your factory workers are picketing like it’s their full-time job, it’s hard to run a profitable business (don’t need a business podcast to explain that one).

Let’s set the stage. Boeing’s CEO, Kelly Ortberg, took over last August, presumably after losing a coin toss. And boy, does he have his work cut out for him. The company is losing the delivery race to Airbus, dealing with fallout from a two-month machinist strike, and recovering from what can only be described as a year-long blooper reel of manufacturing mishaps. I’m not even going to bring up the mid-flight door blowouts or the endless parade of other Boeing disasters… let’s keep it classy. Instead, let’s dive straight into the numbers, because that’s where Boeing’s comedy gold really shines. For the fourth quarter alone, they managed to rack up a $3.86 billion loss. That includes $3 billion in charges spread across their commercial aircraft and defense units.

And it gets better. Revenue for Q4 dropped 31% to $15.24 billion, coming up short of analysts’ expectations by a billion dollars. The real punchline that will make heads roll? A cash burn of $14.3 billion for the year (that’s a reversal from the $4.43 billion cash inflow they posted in 2023).

Don’t go home yet, there’s still some jokes left… The company’s defense, space, and security business (responsible for everything from tankers to Air Force One jets) lost an impressive $5.41 billion last year. Let that sink in. They’re building planes for the President of the United States, and somehow can’t make a profit. (Honestly, with government budgets being what they are, that’s almost a skill.) Even Ryanair Airlines' Michael O’Leary is frustrated, saying Boeing’s delays forced him to lower passenger targets. When a guy who’s famous for charging passengers to use the bathroom is complaining about your service, you know it’s bad.

Ortberg insists they’re making progress. He’s laid out a four-part plan to fix Boeing’s culture, stabilize production, and streamline their portfolio. But here’s the thing: turning around Boeing isn’t a quick fix. Ortberg himself called it a “multi-year journey.” (This is the corporate version of an NFL coach telling fans to “trust the process” during a three-season tank job.)

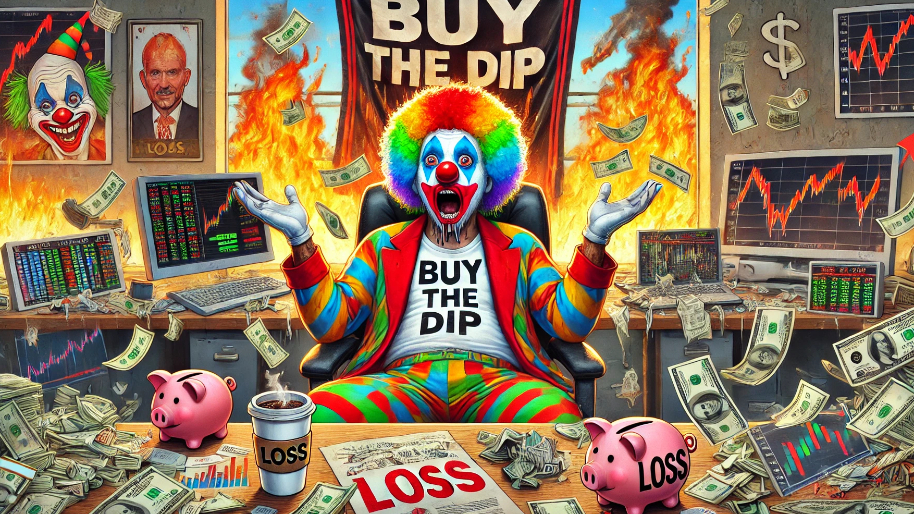

As a self-proclaimed Boeing comedian, even I have to give credit where it’s due: Boeing does have one thing to get excited about. Somehow, they’ve managed to hold onto $26.3 billion in cash and short-term securities. That’s a solid cushion for a company clawing its way out of what has to be one of the worst six-year runs in corporate history. But let’s be real… this is Boeing we’re talking about. If there’s a way to fumble that bag, they’ll find it. On a serious note… Boeing is a perfect example to look at in regards to the “buy the dip” style of investing. You never know if you’re buying into something that ends up in a decade long dip.

PS: Our "Insider Trade Tracker" just flagged two power moves that you should know about. Peter Anevski, CEO of Progyny, and Executive Chairman David Schlanger both made their first-ever open-market buys of the company’s stock. Anevski dropped $3.03 MILLION to grab 209,500 shares at $14.48 each, while Schlanger followed up with a $2.2 MILLION bet for 150,000 shares at $14.68 a pop.

Progyny’s stock has been flirting with recent lows, but with a booming market for fertility benefits and major clients like Google and Microsoft on their roster, these guys are clearly betting on brighter days. Call it a growth story in the making—or at least that’s what their wallets are saying.

Moves like this are exactly why our tracker exists: to show you where the smart money is going before everyone else catches on.

Oh, and FYI, we recently ranked #23 for free News Apps, ahead of Bloomberg and The Washington Post. 🎉 Curious to see what other power plays we’re tracking? Become a Stocks.News premium member today… or just keep enjoying our free content. No pressure. 😉

Stock.News does not have positions in companies mentioned.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer