Stocks News

Ultimate Stock News Source

CIK: 0001037389

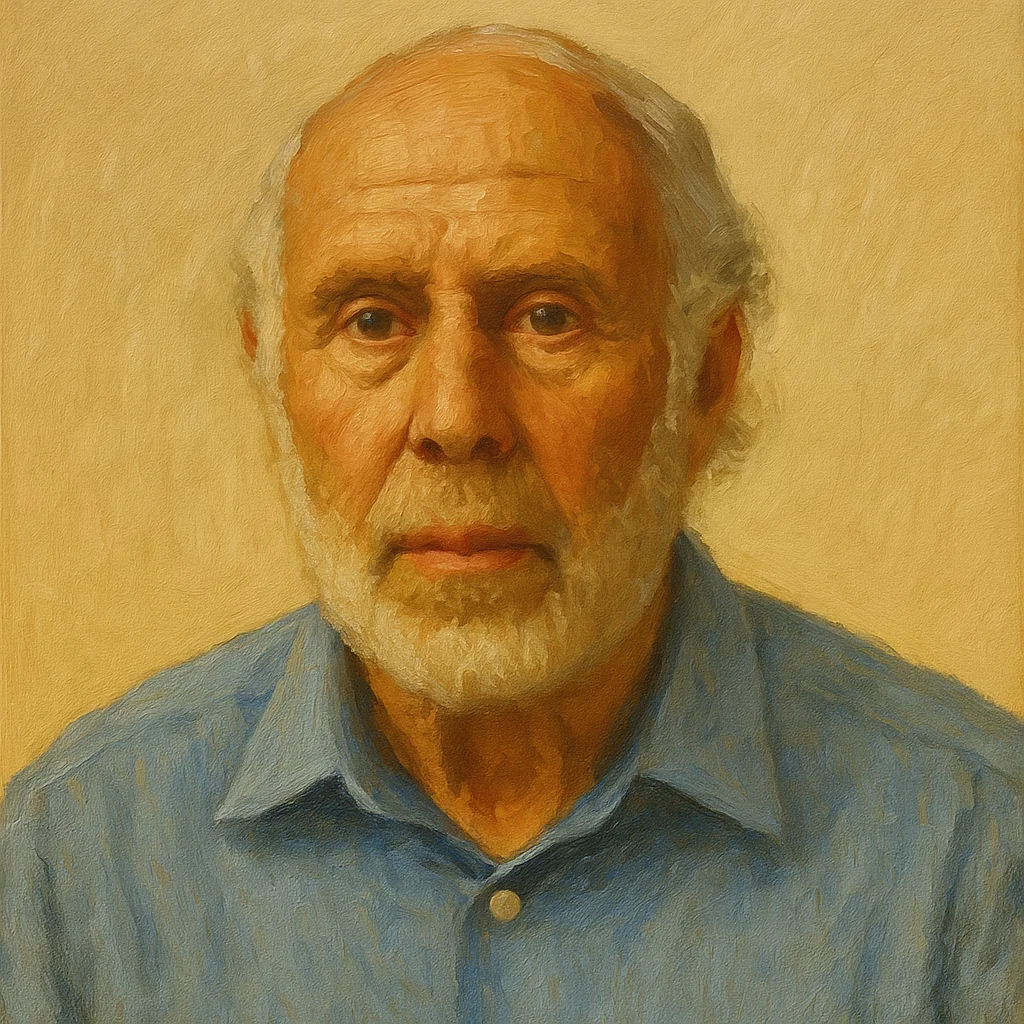

A mathematician, hedge fund manager, and founder of Renaissance Technologies, he is acclaimed for his groundbreaking work in quantitative investing and the use of mathematical models to capitalize on market inefficiencies.

We are preparing, please wait

A mathematician, hedge fund manager, and founder of Renaissance Technologies, he is acclaimed for his groundbreaking work in quantitative investing and the use of mathematical models to capitalize on market inefficiencies.

Explore Jim Simons largest investments on Stocks.News, including companies like Bristol-Myers Squibb Company , Zoom Video Communications, Inc. , Novo Nordisk A/S , and their significance in his portfolio.

Jim Simons portfolio updates are typically published quarterly through SEC 13F filings, which provide detailed information about their holdings, including recent buys and sells.

Jim Simons currently invests in companies such as Seaboard Corporation

The largest holding in Jim Simons portfolio is Bristol-Myers Squibb Company.

As of Jun 30, 2025, Jim Simons portfolio is valued at approximately $75.17 B, based on the latest filings available on Stocks.News.