Wall Street Fear Hits Alien Invasion Levels? It’s Going DOW-n, I’m Yelling “TIMBER”...

Friday, April 4th, 2025. Mark it down. Frame it. Light a candle… Because this was one of the nastiest days in stock market history.

The Dow plunged 2,000 points, a 5% drop… its worst single-day collapse since June 2020, back when we were disinfecting Amazon boxes and watching Tiger King. The S&P 500 matched that pain, also down 5%. And somehow, the Nasdaq was the winner of the losers, Down 4.7%, now 22% off its highs… officially putting the index deep into bear territory (though you probably already knew that if your Reddit feed is currently drowning in “my portfolio is down 50%” memes). So what exactly was the catalyst for one of the worst market meltdowns in recent memory?

It started with China swinging first… announcing a massive 34% tariff on every U.S. product it could get its hands on, from airplanes to almonds. It was Beijing’s not-so-subtle way of saying, “If you’re going to play hardball, so are we.” This came just days after Trump’s latest round of sweeping tariffs.

Never one to back down from a fight (especially one that involves a microphone), Trump fired back with another round of tariffs, doubling down rather than dialing things back. Investors, already nervous, suddenly realized this was far more than political posturing… it was turning into a full-blown economic street brawl between the world’s two largest economies (rumor has it Dana White’s already in talks with Trump and Jinping).

Then came the final blow… Fed Chair Jerome Powell took the stage and delivered what might be the most deflating speech since “there is no Santa Claus.” He confirmed what everyone feared: inflation is still a problem, growth is slowing, and the Fed? Yeah, they’re just going to “wait and see.” No emergency cuts. No stimulus. No cavalry. Powell might as well have strolled into the ER, looked at the patient flatlining, and said, “Let’s give it a minute.”

This wasn’t your typical “oh crap the market’s down”... it ranks right up there with Black Monday 1987, COVID’s March 2020 collapse, and the Flash Crash of 2010.

But in the middle of the storm, a familiar face made a surprise appearance: GameStop. While everything else was getting wrecked, GME soared 11% because CEO Ryan Cohen bought 500,000 shares. Somehow, while giants were falling, a meme stock stood tall.

And then there’s Warren Buffett, sitting on his mountain of $334 billion in cash, sipping Cherry Coke and watching everyone lose their sh*t. In February, critics whined that he was “missing out.” Now, Berkshire is up 8% this year, while the S&P 500 is down 13%. BlackRock’s Rick Rieder said what we’re all thinking: Tariffs are killing business confidence. CEOs are freezing hiring, shelving mergers, and shredding R&D budgets like it’s 2008 all over again. He called it a “sea change” (possibly the only thing we can all agree with BlackRock on).

In response to the criticism, Trump jumped on Truth Social (also down 49% ytd) to declare, “My policies will never change.” Ex-Goldman CEO Lloyd Blankfein, on the other hand, was practically begging the guy to stop swinging: “Take the win!” he posted. “We’re tired of winning!” (We are, Lloyd. We really are.)

Even Powell looked uncomfortable. He admitted the tariffs were “larger than expected” and said they’ll likely push inflation higher and tank growth. But don’t expect the Fed to ride in on a white horse. “We’re well positioned to wait,” he said (he must be in all cash like Buffett).

Treasury Secretary Scott Bessent made a valiant attempt to shift the blame, saying this was all a “Mag 7 problem” and had nothing to do with Trump’s tariff policies. But that excuse fell flat as Apple dropped 7%, Tesla lost 10%, and Nvidia sank 8%.

To top it off, the Semiconductor ETF had its worst week since 2001… the same era when half the internet companies disappeared overnight. And the VIX, Wall Street’s panic button, blasted above 40, a level typically reserved for pandemics, banking collapses, or alien invasions. So with all that said, have a great weekend!

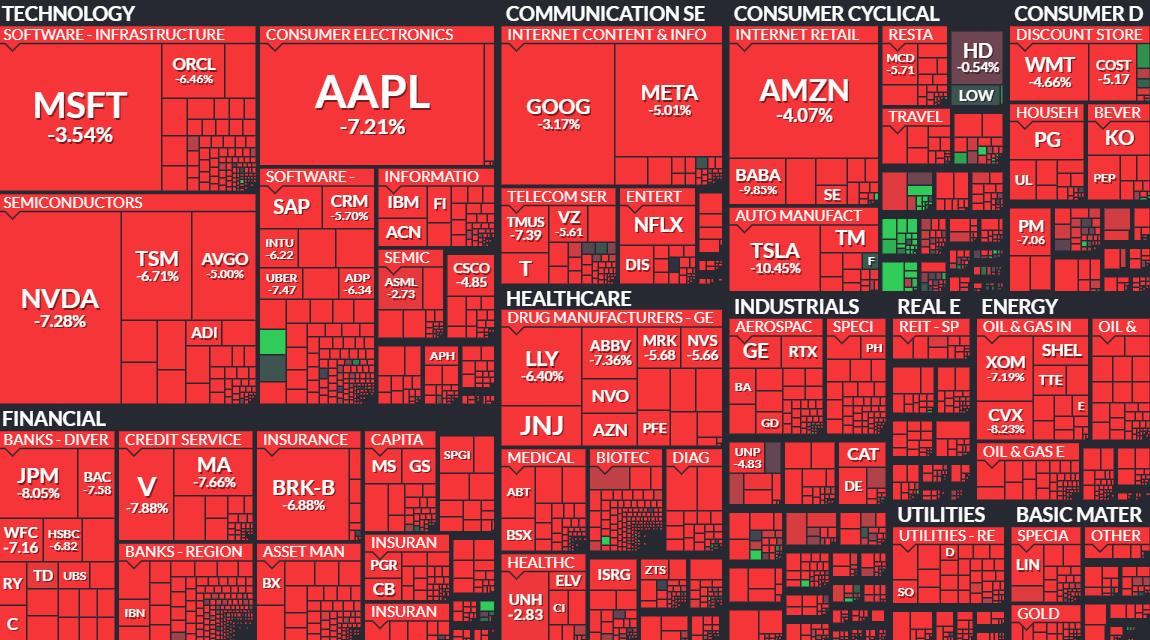

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.