Twitter Trolls Expose Michael Burry’s “All Bark, No Bite” Take on Tesla

All bark, no bite…

Happy New Year… unless you’re Michael Burry on Twitter (or X) today. Because the man just committed the cardinal sin of market doomsayers: publicly treating a stock like it’s the Bubonic Plague… without actually shorting it.

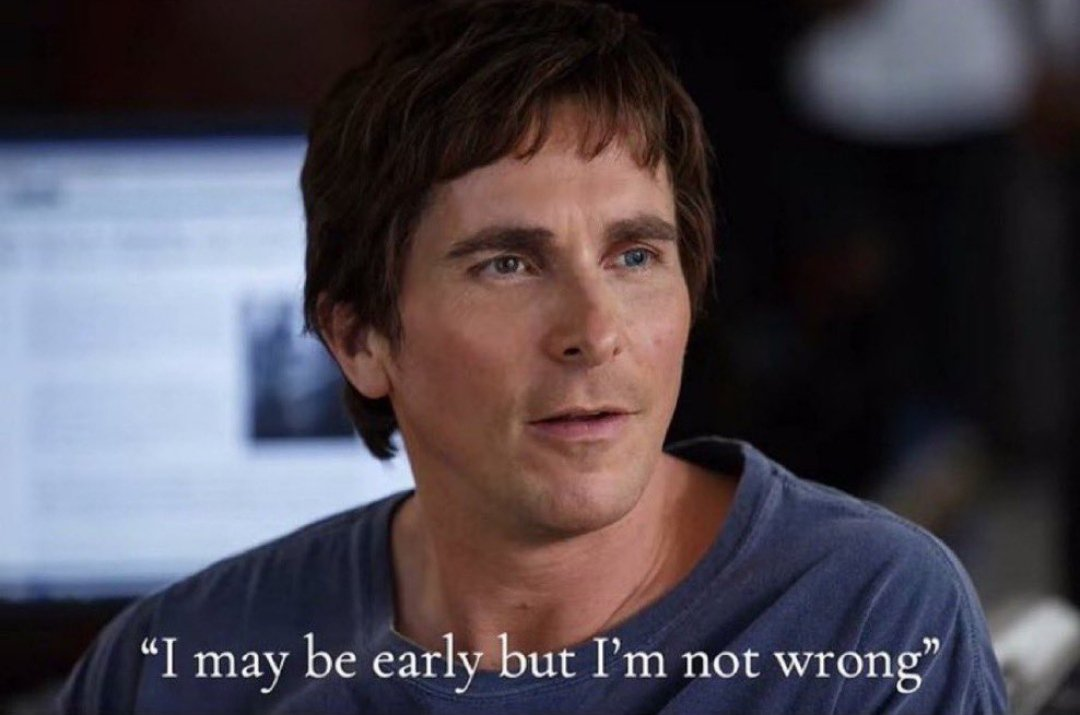

That’s right. The barefoot office nerd immortalized by The Big Short logged onto X, got poked by a random internet stranger, and calmly replied: “I am not short.”

Of course, context matters. Burry had already described Tesla as “ridiculously overvalued,” around the same time that he had just done a huge writeup on his newsletter accusing Jensen Huang of running a circle-jerk fraud scheme. So naturally, when he took shots at Elon, everyone assumed he was loading up on puts like it was 2007 and Florida real estate just coughed on live TV.

But, nope. Instead, Burry chose the most unsettling option possible: judging… but not betting. That’s the financial equivalent of your doctor saying, “I don’t love what I’m seeing here,” and then immediately ending the appointment and billing your insurance anyway.

(Source: Business Insider)

To be fair, Tesla has been doing Tesla things. Shares ended the year up roughly 18%, brushing against all-time highs after getting smoked early by Chinese EV competition and Musk’s extracurricular activities (read: DOGE, xAI, robot armies, Twitter beef with POTUS, etc). But when all was said and done, Tesla bros sent the stock higher like nothing ever happened.

But pop the hood and (yeah) that battery’s running lava hot.

For instance, earlier this week, Tesla did something… how do I say? un-Tesla-like: it published delivery estimates. Translation: management gently cleared its throat and hinted that 2025 deliveries might come in around 1.6 million vehicles, roughly 8% lower than last year. That would mark a second straight annual decline… not exactly the hypergrowth story the valuation still pretends it’s living in.

And remember, deliveries are Tesla’s closest thing to sales. When those start shrinking, investors usually start asking uncomfortable questions. Like valuation. Or gravity.

Meanwhile, Burry has been roaming the market like an unpaid forensic accountant, warning that some of America’s favorite tech names are using AI religion and aggressive math to make profits look healthier than they really are (he may have a point). So yes, he remains deeply committed to his “someone’s lying” phase.

But when it comes to Tesla, he’s choosing restraint where it actually matters: betting against the stock. And in my opinion, that’s because he knows that as much as Elon cries wolf and pumps the story with wild claims, betting against Tesla has historically been a great way to get steamrolled.

Much like Bitcoin, just when the stock looks like a lost cause, it has a habit of coming roaring back. So short sellers can talk tough all they want (and some of them may even back it up) but Tesla remains the stock that even the bravest shorts won’t touch with a ten-foot pole.

At the time of publishing this article, Stocks.News holds positions in Tesla as mentioned in the article.