The ONLY Stock Market Story That Mattered From Trump’s Speech Last Night

While most of the media spent yesterday gawking at a Democratic congressman getting escorted out to the tune of na na na na, hey hey hey, goodbye (truly, the most bipartisan moment in years), and Trump dropping "Pocahontas" on Elizabeth Warren yet again, he was also busy taking a woodchipper to the CHIPS Act.

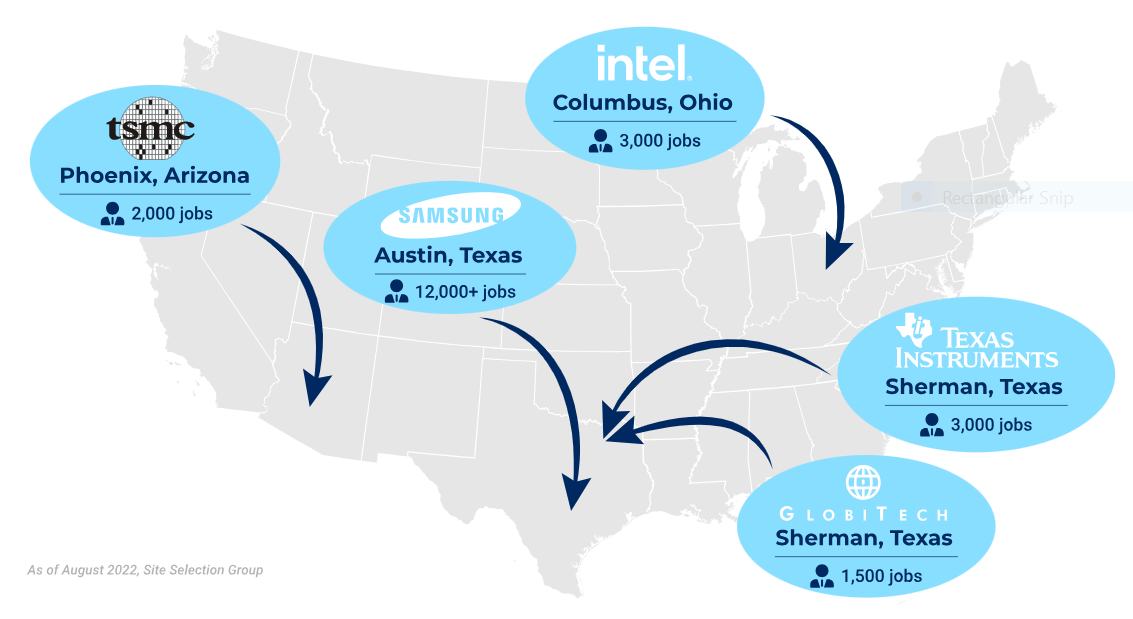

In classic Trump fashion, he got on stage and called the $52 billion semiconductor subsidy program a “horrible, horrible thing” (two horribles, must be serious) and demanded Congress kill it. His argument is that tariffs would be just as effective, and at least the government would be making money instead of throwing it at corporations. Ironically, the CHIPS Act has already triggered over $400 billion in investments, including major expansions from TSMC, Intel, and Samsung. So, what exactly happens if Trump gets his way? Let’s break it down.

The CHIPS Act was designed to make sure the U.S. doesn’t have to beg Taiwan (or China) for semiconductors when push comes to shove. It allocated $39 billion in grants, plus loans and tax credits, to seduce chipmakers into setting up shop stateside. And guess what? It worked. Factories started popping up in red and blue states alike, because, let’s be honest, free money is free money… and politicians love claiming credit for job creation.

Now, Trump says all of that was unnecessary. He believes the real reason TSMC decided to drop $165 billion into U.S. production wasn’t because of government handouts, but because they didn’t want to get whacked with tariffs. He doubled down, saying, “We’re giving them no money,” which probably made TSMC executives smirk a little since they’ve already been awarded $6.6 billion in CHIPS Act grants, with $1.5 billion in the bank.

So, would Trump actually cancel all that money? That’s complicated. First off, most of the CHIPS Act funds have already been spoken for. More than 85% of direct funding is locked into binding contracts. While the government technically has some clawback power, that only applies if a company isn’t delivering on its promises… not because the new guy in charge just doesn’t like the law. That means unless Trump gets Congress to repeal the whole thing (which would be hilarious to watch since plenty of Republicans voted for it), the money will likely keep flowing.

What he could do is slow-walk future payments, cut out some of the labor and environmental rules attached to the subsidies, or use his leverage to renegotiate deals. We all know Trump loves a good renegotiation.

If Trump successfully shuts off the CHIPS Act spigot, semiconductor companies will have a decision to make. They could stick it out in the U.S. and eat the higher labor and construction costs. They could switch production to somewhere else. Or they could lean on tariffs to protect U.S. chipmaking, which could work but could also backfire if companies pass the costs onto consumers.

GlobalWafers, which was promised $406 million for its Texas and Missouri plants, has already hinted that if CHIPS Act funding dries up, they’d have to “reassess future investments.”

Trump’s argument is simple: Why hand companies free money when tariffs can force them to play ball? It’s classic Trump economics… tax foreign products instead of subsidizing domestic production. The problem is that many of these companies are already committed to U.S. expansion based on existing CHIPS Act incentives. If Trump suddenly yanks the rug out from under them, it could erode trust in U.S. industrial policy. After all, if the government promises billions and then pulls a psyche! at the last minute, why would businesses take them seriously next time?

Of course, none of this is stopping Trump from giving himself a pat on the back. He’s already bragging that TSMC’s $165 billion investment is a direct result of his pressure.

If Trump manages to torpedo the CHIPS Act, it’ll be a mess. Congress would have to claw back money that’s already been contractually promised, semiconductor firms would rethink their U.S. plans, and states banking on new factories could be left holding the bag. But actually getting rid of it would take an act of Congress, and with so many red-state projects at stake, that’s far from a sure thing.

PS: Last week, I broke down a stock that both Nancy Pelosi and Cathie Wood just bought… but here’s the thing: it was only available for premium members.

Not only did I reveal the stock, but I also dissected Nancy’s trade structure, proving she’s in it for the long haul. If you weren’t a premium member, you missed the breakdown on why her entry signals serious conviction… the kind of insight that separates smart traders from the ones just chasing headlines.

If you want real stock picks and trade ideas every single day—not just the surface-level news everyone else sees… you need to check out our premium membership. We dig through SEC filings and insider trades daily, flagging the best opportunities. And when we find a can’t-miss trade, we break it down in a full write-up… so you know exactly what’s happening and why it matters.

Don’t miss the next one. Click here and become a premium member today.

Stock.News has positions in Intel.