The Final Tally: Short Sellers FEAST As Layoffs Hit 5-Year-High

Hope you didn’t go all-in on 0DTE AI calls today… unless, of course, you enjoy donating money to market makers. For example, Marvell actually beat earnings expectations and still got sent to the shadow realm, dropping 18%. If that’s not a sign this market is cooked, I don’t know what is.

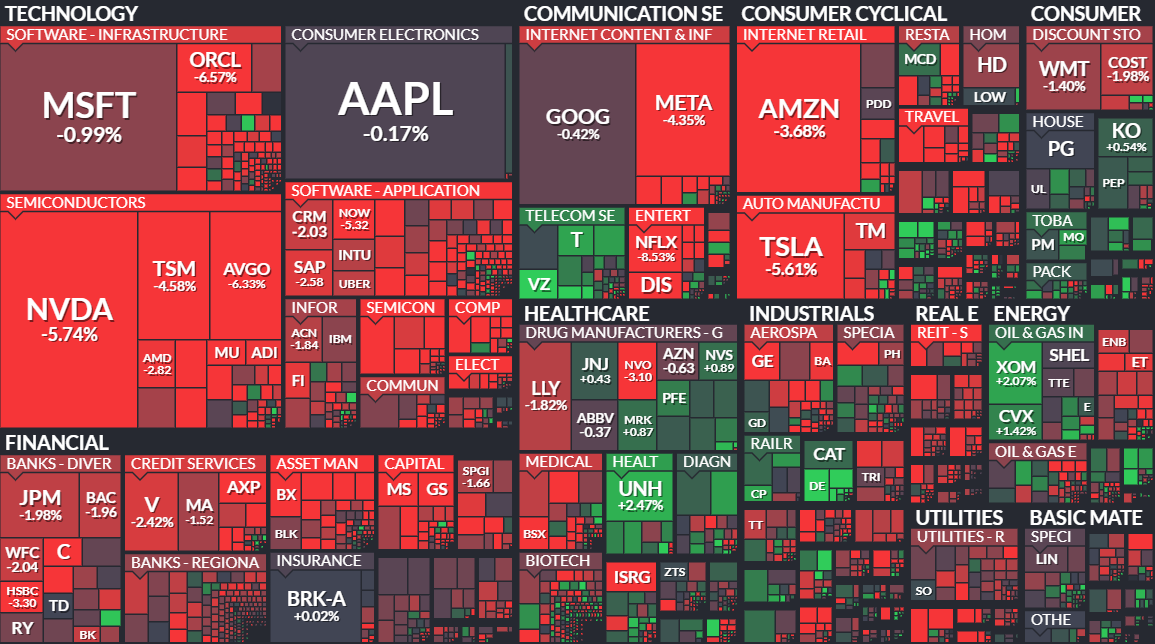

And if you thought the pain stopped there… oh buddy, it gets worse. The Dow cratered 550 points (-1.3%), the S&P 500 tanked 2%, and the Nasdaq got body-slammed nearly 3%. If the Nasdaq keeps this up, it’ll officially be in correction territory… arguably the only thing worse than the “we need to talk” text.

As you predicted, the trade war sitcom got a new episode (something no one asked for). Trump, in his infinite wisdom, hit pause on some Mexico and Canada tariffs… for now. But don’t get too excited… half of Mexican imports and 62% of Canadian goods still face a lovely 25% tariff.

Tech stocks just got taken to the woodshed. Marvell dropped 18%, even after meeting analyst expectations. But Wall Street, being Wall Street, decided to move the goalposts… spooked by rising short interest and the fact that Marvell didn’t pull off Nvidia-like numbers or magically 10x its revenue overnight. Shocking.

Speaking of chip stocks… Nvidia, Broadcom, and AMD all dropped like a rock too. Falling 5%, 6%, and 2% respectively. If you bought the dip after the DeepSeek disaster… I’m sorry.

And then there’s Tesla, which fell 6% after Baird lowered its price target from $440 to $370 (honestly, they were being generous).

Oh, and layoffs? Just 172,017 job cuts in February, up 245% from January, the highest in five years (nothing to worry about). Musk and Trump decided the federal workforce needed a good old-fashioned purge, telling 62,242 government workers across 17 agencies to go home.

On the bright side? If you’re the glass-half-full type, today was a phenomenal day to buy the dip.

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.