The Final Tally: Powell Speaks In Riddles… Truth Social Finds a New Home

The Federal Reserve did exactly what everyone expected… kept interest rates at 4.25%-4.50% (the suspense was killing us). But in true Fed fashion, it still managed to jerk stocks around. Along with the no-change decision, policymakers quietly nudged their inflation forecast higher and just to keep things exciting, left their 2025 rate-cut projections completely untouched. We had all been hoping for a sign (any sign) that rate cuts were coming sooner rather than later. Instead, we got Powell playing his greatest hits… vague riddles and noncommittal shrugs.

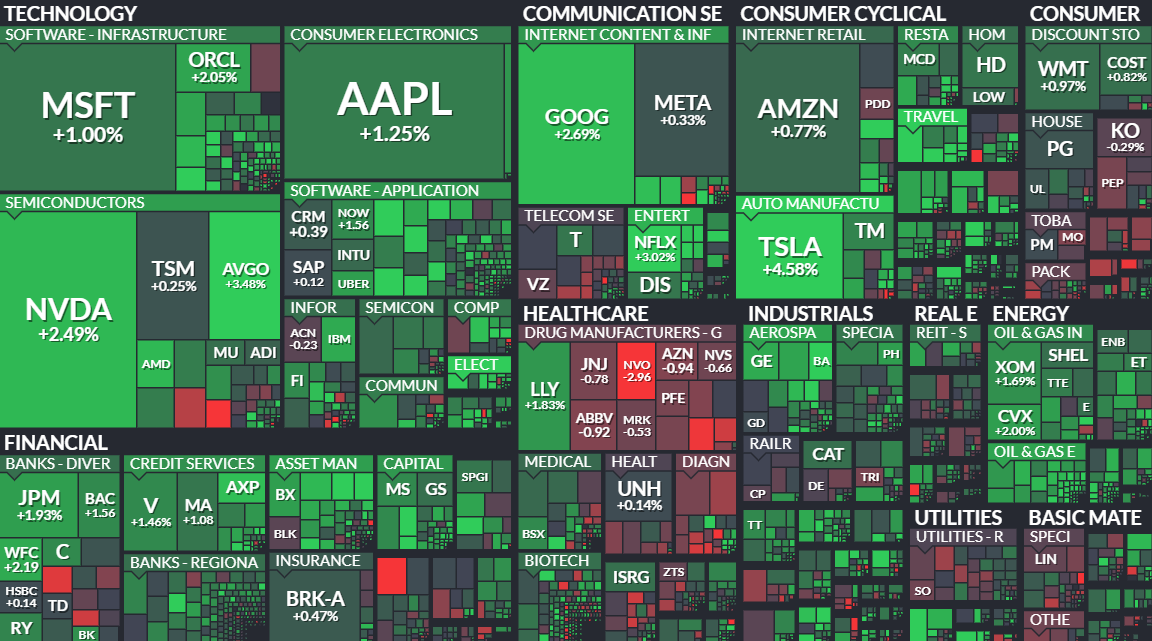

Markets, for the day at least, seemed fine with it. The Dow added about 150 points, a 0.4% gain, while the S&P 500 climbed 0.6%. The Nasdaq led the charge with a 0.9% jump, bouncing back from Tuesday’s AI selloff as the Magnificent 7 wrapped up their worst quarter in over two years. Investors tuned into Powell’s press conference hoping for clarity, but (shocker) he delivered none.

Instead, he dismissed weak consumer sentiment like it was nothing. Just because surveys show people are worried about the economy, Powell reasoned, doesn’t mean they’ll actually stop financing luxury SUVs and splurging on the latest iPhones. The Fed wants to see more “real” data before making any big moves.

Over in the stock world, Nvidia crawled back 2% after taking a beating in Tuesday’s tech sell-off. Investors found renewed hope in CEO Jensen Huang’s latest AI sermon at the GTC conference. Over in Austin (the promised land of brisket, tacos, and overpriced real estate) Tesla surged 4% after Cantor Fitzgerald upgraded the stock to a Buy, calling the recent sell-off an “attractive entry point.”

In other words, his entire argument was that it's been beaten down so badly that maybe it won't keep falling. The firm pointed to Tesla’s autonomous ride-hailing push in Austin and expansion of its Full Self-Driving software as catalysts.

Not every stock had a good day. General Mills slid 2% after lowering its full-year sales forecast, citing weaker demand for cereals and snacks. CEO Jeffrey Harmening admitted that their expectation for a consumer spending rebound “hasn’t really been the case.”

Then there was Roku, which saw its stock jump 10% after Trump Media & Technology Group announced that its new streaming platform, Truth+, is now available on Roku devices. The app promises “family-friendly programming for patriotic Americans,” offering an alternative to what it calls “woke entertainment.” DJT shares gained 3% on the news, but given that the stock is still down 39% this year, this feels like putting a fresh coat of paint on a car with a blown engine… sure, it looks better for a minute, but it’s not getting far without a serious fix.

So where does that leave the market? If you're still straining to find a rate-cut signal in the tea leaves, you’re not alone. But Powell has made one thing abundantly clear… he’s in no rush. In my opinion, stocks will keep bouncing between short-lived rallies and sharp pullbacks, and there’s no sign of that changing anytime soon.

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.