The Final Tally: Nasdaq Breaks Major 12 Month Support Level As Nvidia Faceplants -8%...

“I told you so…”

I’m not saying I saw it coming, but I’m not saying I didn’t. Today was another sea of red as the S&P 500 and Nasdaq both dropped 1.6% and 2.8%, respectively due to the fact Nvidia got absolutely rekt after its earnings. Share’s of the chip giant tumbled 8% as the AI hype cycle started looking a little too frothy for its own good.

(Source: Giphy)

Now with that said, it wasn’t that Nvidia’s earnings were bad. In fact, they were solid—exactly what analysts expected. But when a stock more than triples in two years, “solid” doesn’t cut it. Simply put, Wall Street wanted divine intervention, and all it got was a company that’s still dominant, still printing money, but apparently not doing enough to justify its absurd valuation. Investors finally realized that maybe, just maybe, paying 40 times forward earnings for a chipmaker isn’t a risk-free bet. And now, here we are.

Additionally, Salesforce didn’t fare much better. The stock dropped 3.8%, despite beating profit estimates, because its AI-powered sales pitch is starting to feel like a desperate attempt to convince investors it’s still a growth company. Turns out, slapping "AI" onto a 25-year-old CRM platform doesn’t magically double your revenue overnight.

Meanwhile, Snowflake somehow escaped the carnage, rising 5.7% after delivering an earnings beat. Somehow, the data cloud company managed to survive the AI reckoning—for now. However, don’t think for a second that the AI trade has gotten less selective… It's only a matter of time before Snowflake is next in the “yeet” line.

In other news, while AI stocks were getting their teeth kicked in, eBay quietly had one of the worst days on the market, dropping 8% after its first-quarter revenue guidance came in weak. Wall Street was expecting $2.59 billion, but eBay served up a piss poor range of $2.52B–$2.56B. Investors, of course, punished the stock.

(Source: Giphy)

But, but, but… good news, Rolls Royce took “F’in in a Rolls Royce” literally as shares absolutely ripped, up 18% after a better-than-expected full-year earnings and juicing its stock with a $1.27 billion share buyback. Oh and they reinstated their dividend for the first time since the pandemic. Bigly.

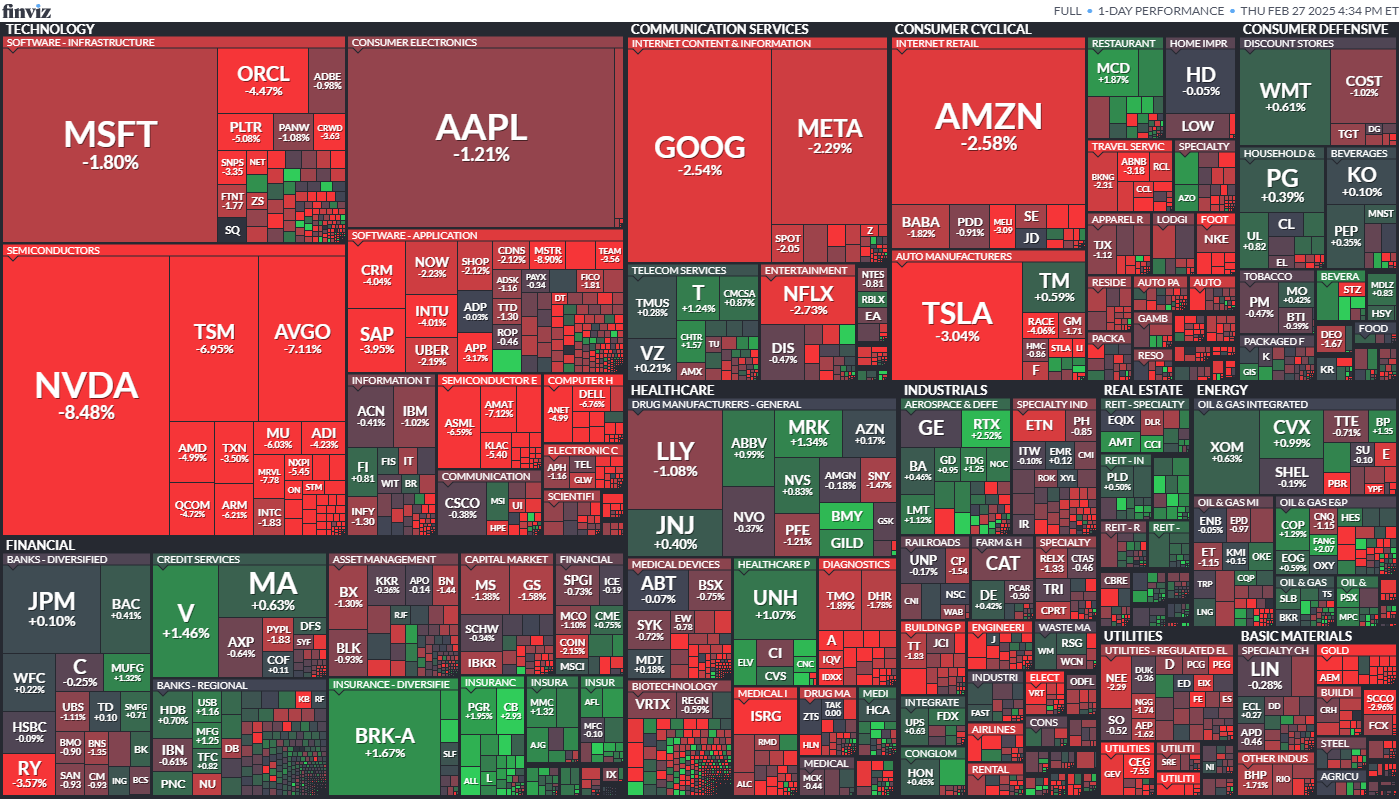

The bottom line here? This isn’t the end of the AI mania, but it’s definitely the end of the free ride. The market is finally demanding actual revenue growth, not just hype, and companies that can’t deliver are going to get shredded. So yeah, reality has kicked in, and considering the Nasdaq has already broken through a major support level dating back to January 2023 (read: 19,350 area)… the road down seems way more likely than the road up. Greaaat. Until next time…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Stocks.News does not hold positions in companies mentioned in the article.