The Final Tally: Markets Gone Wild—Tariff Pause Ignites 3,000 Point Eruption…

Well, we finally did it. We found something that can make Wall Street scream with joy like it’s 2008…but, like, the fun part of 2008 (a.k.a. Not the part where Lehman vaporized American capitalism for a hot second). But when I say fun, I’m talking about a full-blown, face-melting, portfolio-bulging rally that makes every retail trader question if “this is real life” or not.

(Source: Giphy)

Spoiler: It’s 100% real, my friends. During today’s madness, the S&P 500 exploded 9.5% higher—its third biggest one-day gain since WWII. The Dow Jones ripped nearly 3,000 points. Meanwhile, the Nasday yeeted itself 12% higher in a single session, racking up its second-best day ever. And just to make sure no one missed it, 30 billion shares traded hands, presumably between hits of Celsius and extreme FOMO.

The reason you ask? Because Daddy Trump logged into Truth Social and finally said something that made everyone breathing oxygen happy. “I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately,” he posted. Oh, and he also mentioned China is officially rekt with 125% tariffs.

(Source: Giphy)

So yeah, basically everyone except China gets a break. The rest of the world slides back to a 10% baseline while negotiations “happen”. Bigly. For Wall Street though, it was like every trader collectively decided to take nitrous and black out on euphoria. Stocks that had been getting bodied by trade war panic staged the kind of comeback that Kim Kardashian would be proud of. Nvidia ripped 19%. Apple popped 15%. Tesla, which has been mainlining chaos all year, somehow found 22% upside in a single day. Walmart? Up nearly 11%.

Even the crypto mouth breathers were on a sugar high. Strategy pumped 23%, Coinbase added 19%, and Robinhood jumped 21%---which is actually funny, considering this whole rally is probably being driven by their users maxing out leverage on zero context and degeneracy.

(Source: Giphy)

But alas, this was 100% a relief frenzy, plain and simple. Prices were depressed, sentiment was in the toilet, and Trump tossed the market a bone. No one thinks this is over. The tariff threat is still alive and well, and China’s now facing a triple-digit cost wall just to send us more ring lights and air fryers.

In the end, enjoy the party, but don’t forget the house lights are coming back on—and we’ll all be dancing with a recession in the corner. Obviously, I hope I’m wrong. All I’m saying is place your bets accordingly (or don’t). Just don’t don’t act surprised when this thing rips the other direction in 89 days. Until next time, friends…

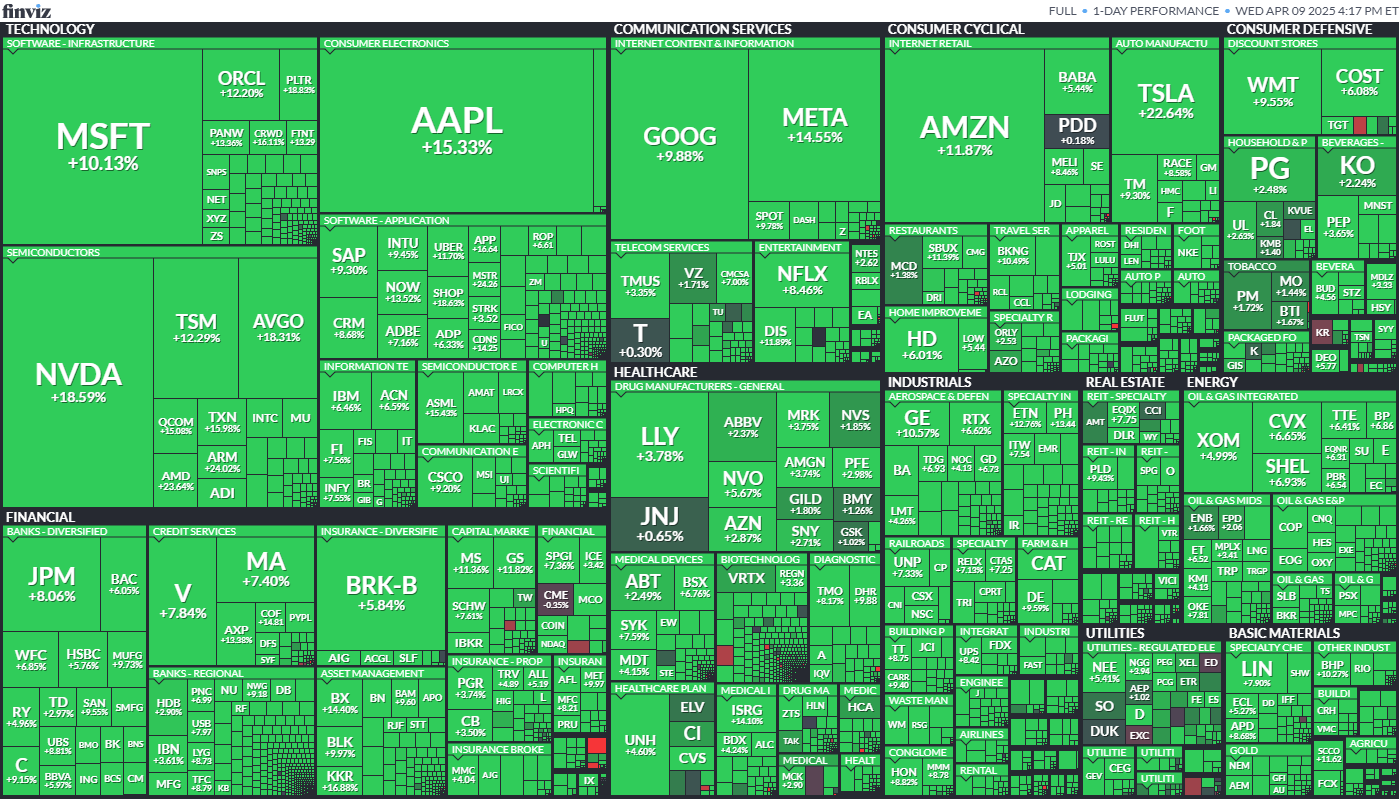

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

P.S. The markets played a better rendition of “Eruption” than Eddie Van Halen, and everyone and their mom was in the mix. However, it was the Stocks.News premium members who really ate today. Click here to ensure you get the juicy exclusive’s for tomorrow's price action here…

Stocks.News holds positions in Apple, Tesla, and Robinhood as mentioned in the article.