The Final Tally: Market Snorts Nine-Day Winning Streak After Jobs Report Injects Frenzy…

Wall Street just did a line of powdered optimism off the back of a better-than-expected jobs report and decided to pretend the last month of tariff-induced panic never happened. The S&P 500 clocked its longest winning streak since George W. Bush was still pretending “Mission Accomplished” wasn’t ironic — nine straight days up, baby.

(Source: Giphy)

Meanwhile, the Dow spiked over 560 points, and the Nasdaq experienced a liquidity injection that had it soaring 1.51%. The reason? Nonfarm payrolls in April came in at 177,000 — a Goldilocks number that was better than the expected 133K but not so good that Jerome Powell’s going to start rage-hiking rates again. The unemployment rate also held steady at 4.2%, resulting in a report that says we may be slightly cooked, but not enough to ruin the meal. And that was all the green light traders needed to pile back into stocks like it was 2021 and money was still free.

Meaning, the recession fear porn that had traders LARPing as doomsday preppers in mid-April was completely out the window today. Which honestly, is a movie we’ve seen way too much over the past few weeks. Trump whispers something about tariffs, the market shats itself for 48 hours, some hedge fund guy cries on CNBC, and then… everyone remembers they don’t actually care as long as the Fed isn’t raising rates while they’re asleep.

(Source: Giphy)

That is unless you’re an Apple investor. Timmy Cook & the boys gave investors a one-two punch to the throat today after their services revenue missed estimates and they warned tariffs would add $900 million in costs next quarter. Shares tanked -3.7%. On the other hand, Amazon boasted a beat on both top and bottom lines, but fumbled its guidance while blaming “tariffs and trade policies” too. But even still, the Street as a collective didn’t care, because the only thing that mattered today was that people who don’t make F150s and sourdough bread their entire personality have jobs.

Meanwhile, Duolingo randomly decided to go god mode, jumping 18% because apparently, teaching people how to say “I am eating an apple” in 37 languages is the new hedge against geopolitical collapse. Airbnb’s CFO admitted that foreign travelers are ghosting the U.S., but that only makes up 2% of their business, so whatever… who needs Europe anyway. ‘Merica!

(Source: Giphy)

Block, however, got absolutely annihilated. Down 20% after cutting full-year guidance and missing revenue. Spoiler: Check out the Congressman who got a taste of his own insider trading cookin’ here.

In the end, the market was on a heater today. Not because things are good, but because they’re not as bad as they could be, and that’s all it takes. Meaning, right now Wall Street and every S&P 500 index boomer is loving every second of it. Until next time, friends…

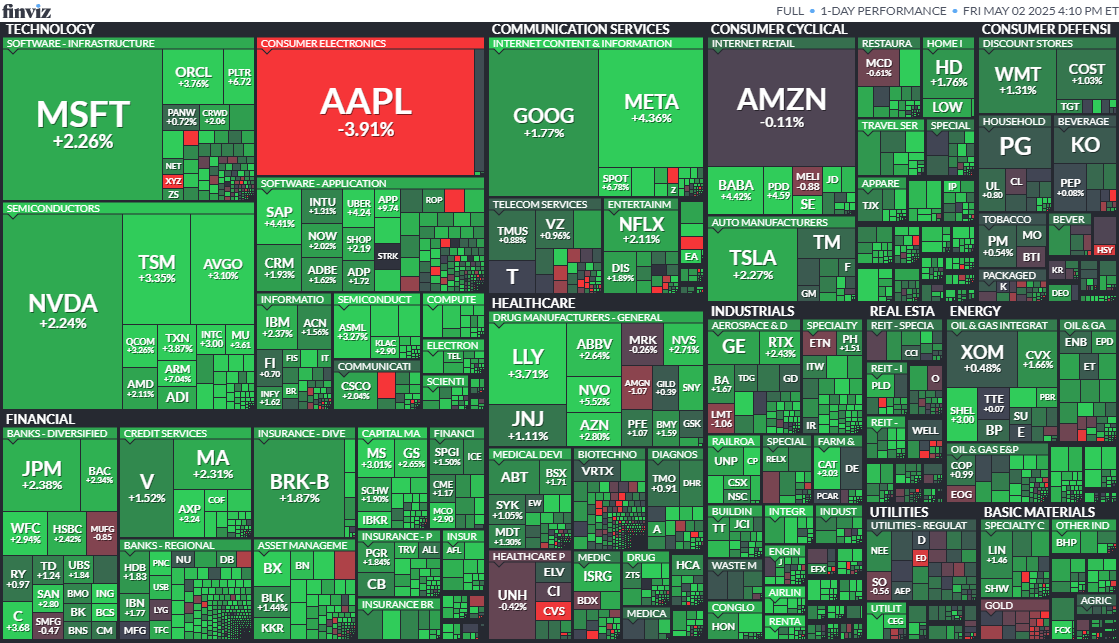

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

P.S. Oh, I’m sorry, I didn’t know you liked getting rekt. Let’s face it, retail investors get the short end of the stick all day everyday. It’s the smart money’s world, and we are just living in it–only useful when it comes to liquidity purposes in the market. Meaning, if you’re as pissed off as I was when I found out Milli Vanilli was lip syncing the whole time, then it’s time to go from investing blind, to investing smart. Luckily for you, the key is right here as a Stocks.News premium member. Click here to see exactly how our premium members are printing while others quake in the face of today’s market chaos.

Stocks.News holds positions in Amazon and Apple as mentioned in the article.