The Final Tally: Lost in Translation: Geneva Edition… The Fed’s “Great Divide”

When Trump first got elected, I thought, “Alright, some people would fight him in a parking lot, others would drink his bathwater, but let’s give the guy a shot… maybe the tariff stuff is part of some genius masterplan.” But now? I’m starting to think the entire plan is just cry, yell “they’re cheating,” and throw tariffs at anything with an accent. The guy treats international negotiations like a bad breakup… “You didn’t text back fast enough, so I keyed your economy.”

Which takes us to what happened today: This morning, China hit back at Trump’s accusation that they violated the Geneva truce… a 90-day agreement reached in late April to temporarily suspend new tariffs while trade talks resumed. Trump, posting from Truth Social, claimed China had breached the deal by continuing to restrict access to critical minerals. Beijing responded that it’s the U.S. that broke the deal by failing to follow through on commitments.

This blame game blew up after Trump announced on Friday that he would double tariffs on imported steel and aluminum… from 25% to 50%. The move is meant to squeeze foreign producers, especially Chinese exporters, but it also ramps up input costs for American manufacturers. Even the EU (who’s about as relevant as “The Backpack Kid”) chimed in, warning that the move “undermines cooperation” and threatens global stability.

Markets, though, could care less. The S&P 500 rose 0.4%, Nasdaq climbed 0.7%, and the Dow just stood there blinking… up slightly, but mostly frozen. It was like watching your grandpa nod off while everyone at dinner passive-aggressively argues about if Taylor Swift actually writes her own music.

Steel stocks were the real winners. Cleveland-Cliffs spiked 24%, while Nucor and Steel Dynamics gained 10% and 9% respectively, thanks to the tariff bump. Meanwhile, Ford and GM dropped 5% each… because when your raw materials suddenly cost a fortune, Wall Street reacts accordingly. Tesla lost 3% after Reuters reported May sales dropped in key European markets like France, Spain, and Sweden. Norway helped a bit with the facelifted Model Y, but not enough to offset the slump.

Meta-linked ad giants like Omnicom and Interpublic took a beating too (down 4% and 2%) after reports surfaced that Zuck wants to fully automate Meta’s ad biz with AI by year-end.

Then there’s the Fed. Some policymakers want to start cutting rates. Others, scared by potential inflation from tariffs, say “not so fast.” Governor Chris Waller came out Sunday saying any tariff-driven price hikes will be temporary. His exact words: “I support looking through any tariff effects on near-term inflation.” (Which is central bank lingo for: “We’ve lost control, but please keep acting normal.”)

Bitcoin ETFs had a rough one. After six straight weeks of inflows, they saw $616 million in outflows Friday… the worst since February. BlackRock’s IBIT and ARK’s Bitcoin fund were the biggest losers. Blame it on the trade war tension, or maybe just crypto fatigue. Either way, it snapped a streak.

Now all eyes are on Friday’s May jobs report. That data drop could be the final puzzle piece for Powell’s next move. Will he cut rates? Hold steady? Or just sigh loudly into a mic at the next press conference?

Until then, the world waits to see if Trump and Xi actually pick up the phone and put their egos aside long enough to meet somewhere in the middle (which is about as likely as China giving up censorship).

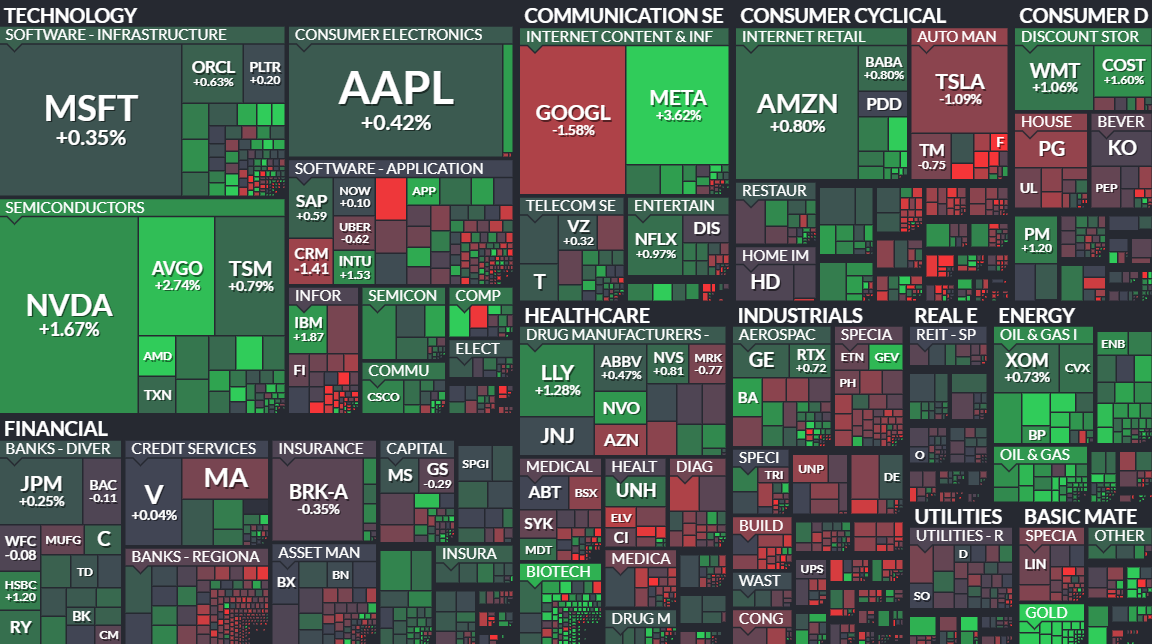

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.