The Final Tally: Dow Rises 141 Points As GDP Vomits On Itself, Wall Street Pretends Its Cologne…

Well friends, sorry to break it to you but even though the Dow rose 141 points today, it’s basically the same as saying the Titanic technically made it a few feet further before sinking. It’s a number, sure, but it’s not the story. The story is that the U.S. economy just threw up on itself in front of everyone, and Wall Street’s pretending it’s cologne.

(Source: Giphy)

In short, under the hood, today was more of a bloodbath than most care to admit. The S&P 500 was down more than 2% at one point, and the Dow lost 780 points before clawing its way back from irrelevance. Why? Because the U.S. economy is contracting. Not slowing or cooling, but contracting.

For instance, first-quarter GDP came in at -0.3%. That’s a full 180 from the 2.4% growth we saw last quarter. Bigly bad. And the excuses rolled in just as fast as the economy went in reverse. The Commerce Department blamed a spike in imports. Forty-one percent, to be exact. Supposedly, companies were panic-ordering inventory to dodge Trump’s incoming tariffs. Which, sure, that tracks. But honestly, that’s not the full picture. The full picture is that consumer spending cratered. Federal spending dropped (technically good), meanwhile business investment flatlined.

(Source: Giphy)

Trump of course, jumped onto Truth Social and blamed the whole thing on the “Biden Overhang,” which, to be fair, might be the first time he’s blamed Biden for something and actually had a point. Then he told people to “BE PATIENT!!!” and said his policies would take time. Meanwhile, corporate America is taking the hit like a piñata.

First Solar dropped 8% because CEO Mark Widmar said “significant economic headwind.” Translation: Their margins are getting roasted. Additionally GE Healthcare cut its outlook too, claiming to be a victim of the very same thing. Oh, and Big Tech didn’t get a break either. Super Micro Computer, the AI hardware darling that’s been riding Nvidia’s big swinging chips, shat the bed with weak preliminary results and dropped 12%. That barely dragged Nvidia down with it (-0.09%).

(Source: Giphy)

On the other hand, Snap fell off a cliff as shares cratered 15%. Why? Because they know the economy is so screwed up they didn’t even bother issuing guidance LOL. They just shrugged and said, “Macro uncertainty”. Etsy also collapsed -9% as CFO Lanny Baker said they’re “staying nimble” in the face of tariffs and collapsing consumer confidence. Are you spotting the pattern here?

And yet somehow, despite all this, the S&P 500 managed to edge higher and still record its third straight losing month. It’s like watching a guy bleeding from the eyes insisting he’s fine because he still has one working kidney. But hey, the Dow was up today. So everything’s totally fine. Keep scrolling. Keep buying the dip. Keep pretending this isn’t the beginning of the next chapter in whatever fresh hell this economic cycle has planned for us. It’s going to get really hairy from here on out. Until next time, friends…

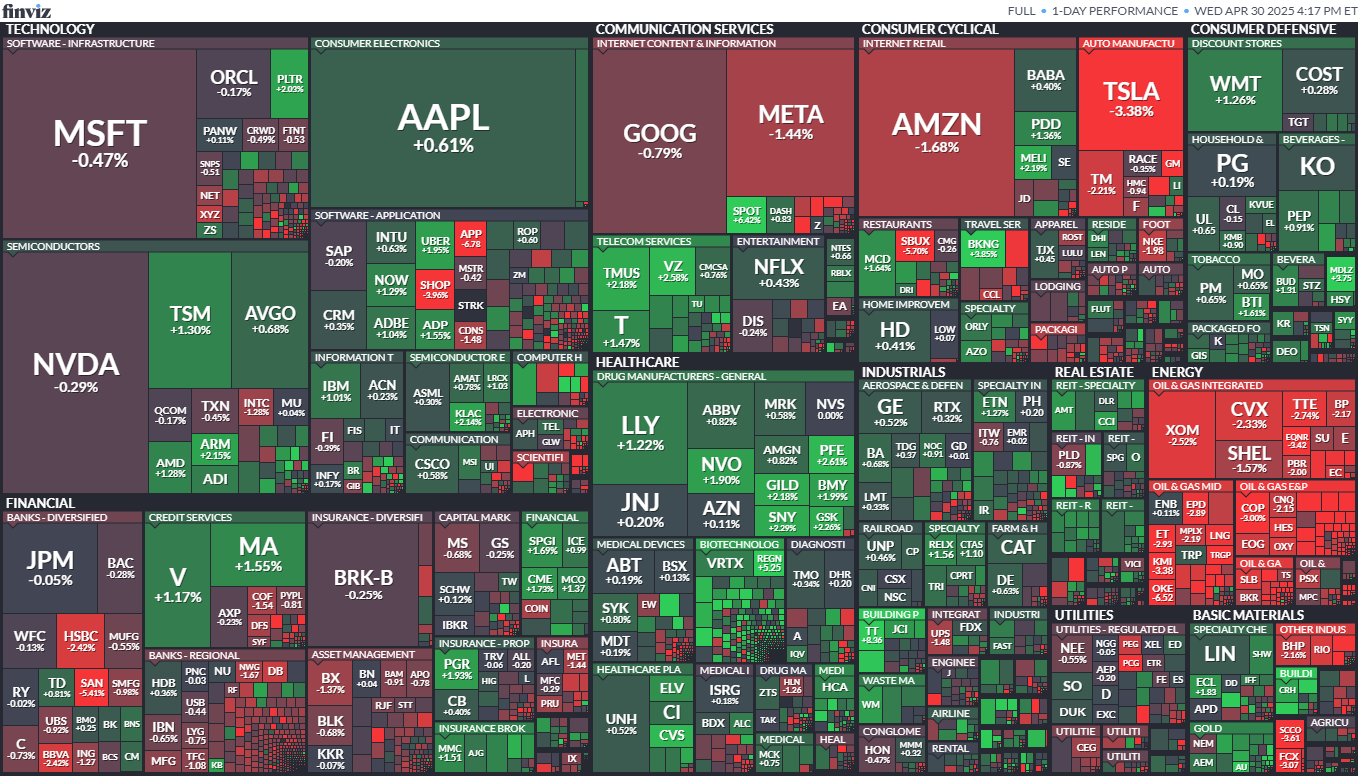

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

P.S. Oh, I’m sorry, I didn’t know you liked getting rekt. Let’s face it, retail investors get the short end of the stick all day everyday. It’s the smart money’s world, and we are just living in it–only useful when it comes to liquidity purposes in the market. Meaning, if you’re as pissed off as I was when I found out Milli Vanilli was lip syncing the whole time, then it’s time to go from investing blind, to investing smart. Luckily for you, the key is right here as a Stocks.News premium member. Click here to see exactly how our premium members are printing while others quake in the face of today’s market chaos.

Stocks.News holds positions in Snap as mentioned in the article.