The Final Tally: Dow Drops 800 Points After Israel-Iran Clash… Wall Street Cancels Vacation Plans

This might be the first time in 2025 that a guy named Donald wasn’t the one sending the bulls back into their cages and the bears up from hibernation. And no, it wasn’t because he finally gave up trying to get Apple to build iPhones in a Charleston Cracker Barrel (although that is very much the case). This time it was war. Real war.

Israel launched a series of airstrikes on Iranian military and nuclear facilities overnight. Iran responded by lighting up the skies with a missile barrage… some reportedly aimed at Tel Aviv. Israeli Defense Forces said, “all of Israel is under fire,” which is not exactly the big headline Wall Street was hoping for heading into the weekend. So naturally, the stock market reacted the same way my stomach did after one of my dad’s infamous chili nights growing up… by completely throwing up on itself.

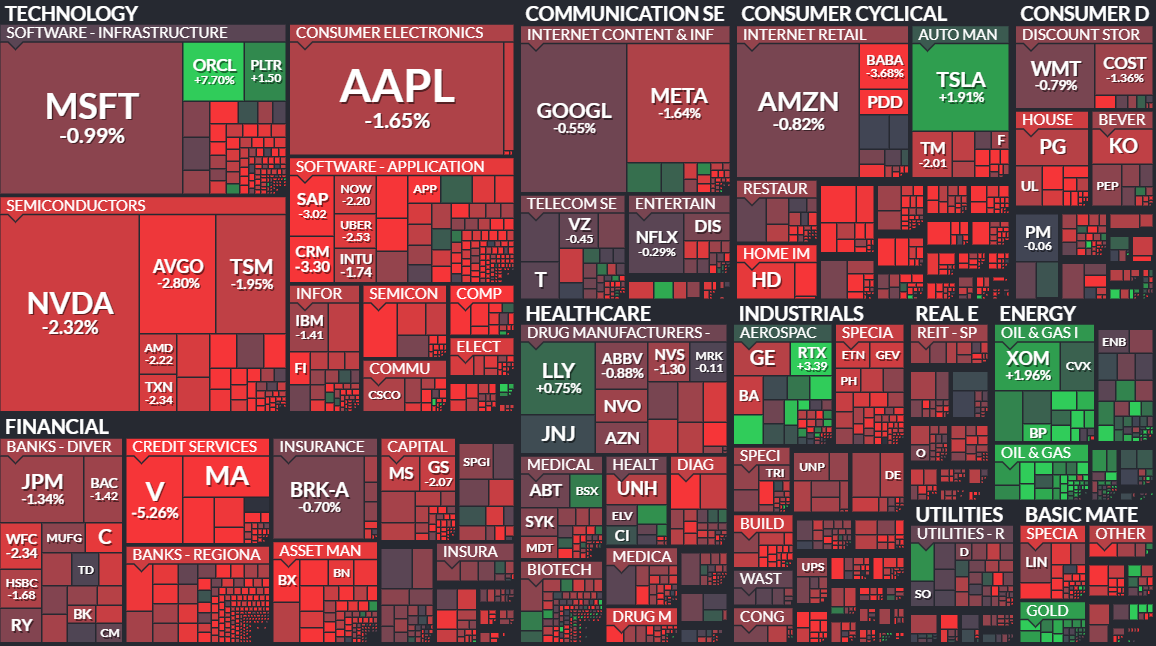

The Dow dropped 801 points (down 2%) its worst single-day decline since early January. The S&P 500 fell 1.2%. The Nasdaq slid 1.3%. Even the mighty Nvidia caught shrapnel, falling over 3%, as investors decided it wasn’t the best time to cling to risky AI plays with names that rhyme with “Vidia”... even if the missiles were flying 5,700 miles away.

Oil, on the other hand, did what oil always does when the Middle East lights up… it soared. West Texas Intermediate spiked as much as 13% during the day before cooling off and closing up 8% around $74 a barrel. Brent wasn’t far behind, jumping over 6%. Every time missiles fly in the region, traders basically smash the “buy oil” button like it’s a reflex. Energy stocks benefited too… Exxon climbed 2.1%, and the XLE ETF finished up 1.3%. War may not be great for peace, but it sure knows how to move a barrel.

And while we’re on the topic of crisis-friendly commodities… gold got the call, too. The ultimate financial panic button rose 1.5% to $3,450/oz, inching toward its all-time high. Defense stocks also rallied hard. Lockheed Martin and RTX both popped over 3%.

And because no one’s exactly itching to vacation where Moses once split the sea and missiles are now flying overhead… travel stocks got absolutely smoked. Airbnb, Booking, Hilton, and Marriott all dropped more than 2%. Airlines fared even worse… American and United both fell over 4%, as oil’s spike made the already-painful economics of flying coach somehow even more difficult.

Of course, in the background of all this chaos, Trump jumped on Truth Social and told Iran to “make a deal” before there’s “nothing left,” and reminded the Fed he’s still very much in favor of a “jumbo rate cut.” When missiles start flying, clearly what we need is cheaper mortgages.

The Fed meets next week and was widely expected to hold rates steady. But now, if oil prices stay elevated, inflation might crawl back out of its cave, and suddenly Jerome Powell has bigger problems than upset Zillow junkies whining about 7% interest rates.

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.