The Final Tally: Dow Breaks Wild 2,594 Point Swing Record while Janover (Who?) Catapults 1,000%!

Would ya look at that. Wall Street just got kicked in the teeth for the third straight day after President Donald “Tariff Daddy” Trump threatened to crank the trade war dial to eleven. Again. The Dow puked up 349 points, the S&P 500 slipped 0.2%, and the Nasdaq miraculously held it together with a 0.1% gain (and everybody said, thank God for Nvidia).

(Source: Giphy)

But hey, we did hit a new achievement today. The Dow saw a record-breaking intraday point swing of 2,595.24 points. It was up nearly 900 points at one point, then down over 1,700. So as you can imagine, traders were getting a full-dose of whiplash, while retail couldn’t reload their Robinhood app fast enough. And somewhere, a hedge fund manager probably rage-chucked his Bloomberg Terminal out the window.

The reason for the madness, you ask? Well, speculation of a “90-day pause” on the tariffs briefly sent the indexes into a sugar high, but the White House came through with the classic guillotine for happiness: “Fake news”. Basically stating, no we aren’t taking a break. Yes this is happening. And yes your margin calls are coming LOL. And I’m not just joking about that either. Chris Rupkey at FWDBonds said it best: “Margin calls are going out as we speak”, meanwhile the CBOE Volatility Index shot up to 60, a level normally reserved for bear markets and financial panic—a.k.a. The fun stuff.

(Source: Giphy)

Now when it comes to where the real carnage has been felt, it’s Apple. The house that Steve Jobs built has single-handedly lost $640 billion in market cap over the past three trading sessions. That’s more than the GDP of Poland. Gone. Vaped. Just because Trump decided to double down on China tariffs and basically tear apart Tim Cook's sweatshops. Shares dumped -3.67% on the day.

On the other hand, Nvidia, Meta, and Amazon put the Nasdaq on its friggin’ back. Nvidia came out swinging, up 3.5% after Bank of America’s Vivek Arya named it a top semi pick with a $200 price target. That’s more than double its current price. If you’re wondering how the hell that makes sense while the rest of the market is on fire — it doesn’t. But it’s Nvidia, so yeah. Additionally, Meta and Amazon both closed the day up 2% due to AI and logistics being immune to trade wars, I guess. Hell, even Bank of America popped 3.4% after Morgan Stanley gave it a pity upgrade, despite cutting the price target. A win is a win, baby.

(Source: Giphy)

Oh, and then there was Janover—who? Exactly. This tiny commercial real estate fintech decided to go full crypto degen and announced it’s adopting Solana (yes, SOL) as its treasury strategy. The stock went up over 1,000%. Meaning, shares literally just embodied the entire personality of the junk Solana is known for feeding—memecoins. Meanwhile, Schlumberger face planted nearly 5% as oil prices collapsed to levels not seen since pre-COVID. Analysts are slashing price targets like it’s Black Friday at Best Buy. The energy sector is getting body-bagged, and SLB is wearing the toe tag.

In the end, tariffs continue causing havoc, all while oil and Apple are bleeding. Volatility is breaking records, and the only people winning are those who decided to buy the dip on Nvidia (read: yesterday). Bottom line: if you're still treating this like a dip to buy without understanding what’s actually breaking under the hood, you’re playing chicken with a freight train. Translation: Place your bets accordingly, friends. Until next time…

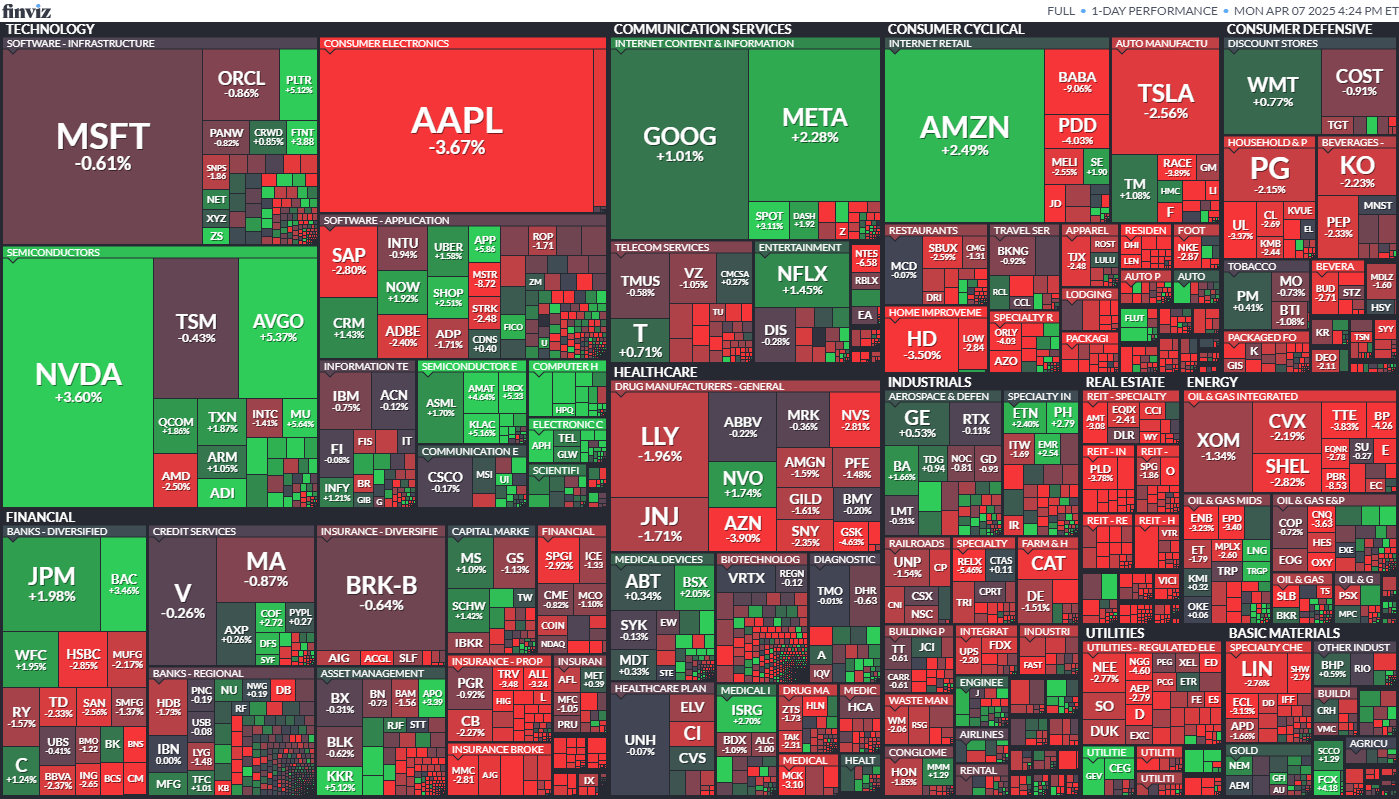

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

P.S. Last week was absolutely horrific. Portfolios are down and emotions are high. But do you know who slayed the week while everyone else is panic-selling? Stocks.News premium members. Click here to join the club, and get the deepest insights and most explosive moves BEFORE everyone else.

Stocks.News holds positions in Apple, Meta, Amazon, and Robinhood as mentioned in the article.