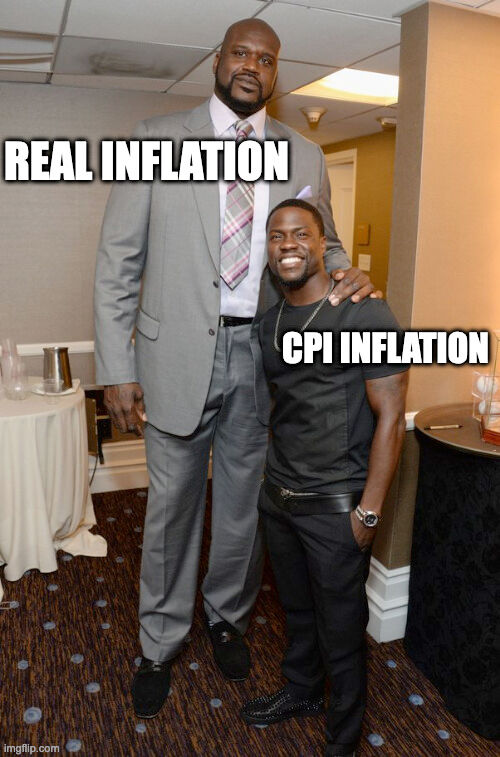

Jay “Scissorhands” Returns After Softest CPI Reading Since 2021… One Thing Could Flip the Script

All the Ivy-league analysts are gonna have to find something else to “raise red flags” about… because, against all odds, the Bureau of Labor Statistics delivered good news on inflation… and yes, it’s government-approved (even during the shutdown).

The long-awaited September CPI report (literally the only economic data Washington’s allowed to publish right now) showed consumer prices rising just 0.3% on the month and 3.0% year-over-year. Both were softer than Wall Street expected.

(Source: CNBC)

Core inflation (the “don’t-blame-gas-or-eggs” version) also eased to 0.2% monthly and 3.0% annually, marking the slowest pace since early 2021. That’s a big deal considering we spent half of last year debating whether groceries were the new Gucci handbag.

Let’s start with the big offender: gasoline prices jumped 4.1% last month… the largest jump in the entire report. Energy prices overall rose 2.8% from a year ago, while food prices ticked up 0.2%. That might not sound like much, but the average American breakfast still costs a pretty penny. Meat, poultry, fish, and eggs are up 5.2% over the past year, and nonalcoholic drinks are up 5.3%.

Meanwhile, shelter inflation (which makes up about one-third of the CPI) cooled to +0.2%, and owners’ equivalent rent saw its smallest increase since early 2021. Translation: rent hikes are running out of breath. (And as someone who owns a few properties, I can confirm… landlords are suddenly a lot less cocky.)

Over at your local dealership, used cars kept losing value (-0.4%) while new cars got a little more expensive (+0.8%). Meaning: inflation may be cooling, but your car payment isn’t.

Since the federal government’s been shut down since October 1, this CPI print was like a drop of water in a desert of missing data. I’ll admit, the Fed’s 2% inflation target still feels like a bedtime fairy tale… like dreaming I made the game winning shot over Lebron James… But this report buys Powell some breathing room.

While the labor market remains flimsy, and tariffs could still sneak inflation back in through the side door, the takeaway is this: prices are cooling just enough for the Fed to keep cutting without looking like total maniacs. Or as I saw one economist put it, “The disinflation trend is intact.” In other words: “go ahead, lower the f***ing rates.” If we’re keeping it a buck, Inflation at 3% isn’t a win… it’s a draw. But compared to where we were two years ago, sign me up.

With a rate cut nearly guaranteed next week and another likely by year’s end, Wall Street’s feeling pretty good. Just don’t get too comfortable… because if gas prices keep climbing or tariffs start biting harder, we could be right back in CPI chaos territory by Christmas.

Until then, enjoy your cheaper eggs, your calmer rent, and Jerome Powell shaking in terror as Trump stands behind him whispering, “Cut them, Jerome… CUT.”

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.