Harvard's $442M FOMO Gets Cruel Reality Check After Buying Bitcoin At The Top…

First Larry Summers, now this?

If Harvard thought being haunted by Larry Summers and his pedo side hustle was bad, they're currently finding out it’s nothing compared to being haunted with the cruel reality of “buying at the top”. How? Because Harvard, the seat of American intellectual elitism, the varsity jacket of generational privilege, just did the single funniest thing a $57B endowment could do: they bought half a billion dollars of Bitcoin at the top.

Crypto mouth breathers to Harvard right now…

(Source: Giphy)

Not figuratively. No, no, no… Harvard plowed hundreds of millions in Bitcoin ETFs… top-ticked with Ivy League precision. According to filings, Harvard jammed $442 million into BlackRock’s iShares Bitcoin Trust last quarter… right before Bitcoin promptly face-planted ~25% from the October highs. Which means the most prestigious investing brain trust in America just recreated the exact experience of some kid named Brayden panic-buying on Coinbase because his barber told him “Bitcoin to 200k by Christmas.”

(Source: Wall Street Journal)

What makes matters worse, is that this isn’t a hedge fund we’re talking about here. This is a university endowment fund… whose sole job is to not lose money. Yet here we are… where Bitcoin is now Harvard’s #1 stock holding. More than Microsoft, Amazon, and the literal GDP booster of the tech world, Nvidia. I can only imagine the same institution that pumps out macro theorists, Fed presidents, and the occasional Treasury Secretary said: “Yeah, put us down for the same trade as the guy wearing a ‘Buy The Dip’ tank top in Miami.” Love to see it.

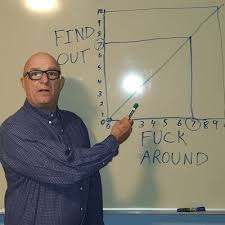

Meaning right now, based on the quarter’s trading range, the best-case scenario is Harvard is down ~14%. Worst case? Don’t make me do that math. And that’s before we acknowledge the fact that Harvard has been chronically underperforming its peers for a decade, trailing MIT, Stanford, Princeton… pretty much everyone except maybe that one liberal arts school where everyone majors in pottery and “social impact frameworks.” So naturally the logic to get their returns back on track was simply buying Bitcoin after it had already been up 34% YTD. F*ck around and find out, amirite?

(Source: Reddit)

With that said, Harvard could’ve sold before the October slide. They could’ve let the ETF do its job and rebalance… and cut their minimal losses like adults before things went haywire. Instead, they loaded the chamber, cocked the hammer, and shot themselves directly in the endowment. Which is exactly why this story hits so hard: Even the smartest people in the world FOMO like the rest of us. No one is safe. Not even an institution with 150 years of compounded wealth and a direct pipeline to Goldman Sachs.

Heck if anything, (for all you crypto mouth breathers reading this), this is bullish. Nothing says institutional adoption like watching elite money managers trip over their own shoelaces trying to get into the trade. Meaning, place your bets accordingly, friends and just remember… it can always be worse. Until next time, friends…

At the time of publishing, Stocks.News holds positions in Microsoft and Amazon