Dan Ives Tells AI Bubble Believers to KICK ROCKS (Tech to All Time Highs?!)

“This MF’er don’t miss…” - Dan Ives about himself, probably

There’s a very specific look analysts get when they’ve been right for too long. It’s that glazed, mildly exhausted stare of a man who’s been explaining the same trade since 2019 while the same five skeptics ask if “this time is different.” Dan Ives walked into Friday with that energy.

(Source: Giphy)

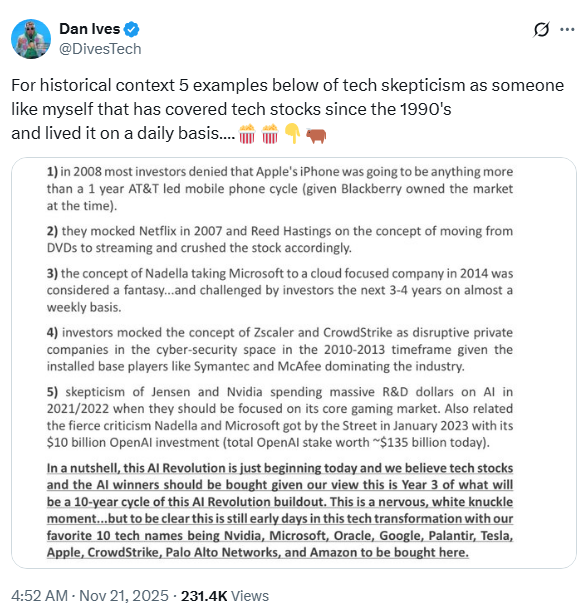

Because somehow, after Nvidia vaporized every earnings expectation in a four-state radius… the market still tried to run the “AI bubble???” play for the 400th time. And Ives basically did what he always does: point at the scoreboard and move on with his day. The man pulled out the receipts too. Apple doubters, Netflix doubters, Microsoft doubters… all wrong. Basically anyone who said cloud was a fad was, in fact, wrong. And now, Ives is basically telling everyone who saw a red candle this week and got flashbacks to 2021 SPAC season can go kick rocks.

(Source: StockTwits)

Meanwhile Nvidia just coughed up $57B in revenue and $1.30 EPS, and the market still tried to pretend this was some kind of top. Which is why Ives wasn’t having it as he keyboard warrior’d his way to say, “Guys, you’ve doubted literally every inflection point of modern tech and been wrong every single time. And here you are again. Congratulations.”

(Source: X.com)

And to be honest, it’s hard to argue with him. With that said, this is the part where people bring up “overinvestment risk” or “AI’s unproven long-term productivity curve.” Meanwhile hyperscalers are lighting $380B on fire this year just to make sure Jensen Huang doesn’t stop calling them back. Oh, and Cathie Wood is also YOLOING 93,374 shares back into Nvidia in the process. Why? Because despite how degenerate Mrs. Wood can be at times, she still understands that Nvidia has a near-monopoly on compute. Add to the fact that Nvidia is down 11% this month… and it’s a clear “BTMFD” opportunity in her eyes.

So yeah… in the end, AI isn’t going way, capex isn’t going down, hyperscalers aren’t going to suddenly decide they’re “good on GPUs”, and Dan Ives isn’t going to stop reminding everyone that betting against foundational tech shifts has been a losing trade for 20 years straight. Meaning, for all the bubble believers, keep on calling it that if it helps you feel something. But according to Ives, if history is a guide… this is probably just another chapter in the same old story: Skeptics panic, tech keeps printing. Place your bets accordingly, friends. Until next time...

At the time of publishing, Stocks.News holds positions in Apple, Microsoft, and Netflix as mentioned in the article.