BYD’s 5-Minute-Charger Drains TSLA… Markets Rally As Traders Bet on Jerome Making it go “BRRRR”

There are only a few things you can count on as an investor in 2025: tariffs, endless Trump headlines, and Tesla continuing to disappoint (even when the market is green). Shares slid another 5% today just when you thought “this is the day the nightmare ends.”

The problem this time? CHI-NA (Trump voice). Tesla launched a free one-month trial of its Full Self-Driving (FSD) software in the country… good news right? Wrong! This move screams desperation rather than innovation. Unlike in the U.S., where Tesla hoards driver data like Apple tracks our every move, China’s strict data privacy laws block the company from shipping that precious information back to its servers. So Tesla is effectively running a beta test with one arm tied behind its back.

And just when Musk thought things couldn’t get worse, BYD (the Chinese EV monopoly that already knocked Tesla off the global leaderboard) decided to twist the knife. They unveiled a new ultra-fast charger that can juice up a car in five minutes (yes, you read that right). They even compared it to filling up at a gas station which has Elon questioning if he’s gonna be able to make all 47 child support payments this month.

Other than Tesla’s slide, broader markets bounced back. The S&P 500 climbed 0.9%, the Dow Jones rose 1%, and the Nasdaq gained 0.7%. But this wasn’t because of good economic news. In fact, quite the opposite.

Retail sales (a key measure of consumer spending) only inched up 0.2% in February, well below the expected 0.6% increase. Worse, January’s already weak 0.9% drop was revised to a steeper 1.2% decline. New York’s manufacturing activity also cratered, with the Empire State Manufacturing Index plunging to -20 from 5.7 in February.

These numbers scream economic slowdown. But in the bizarre logic of Wall Street, bad data means the Fed might step in to cut rates… and that’s exactly what caused today’s rally (we’ll take it). Basically, investors believe that if the economy keeps showing cracks, Jerome Powell and the Federal Reserve will have no choice but to ease monetary policy sooner rather than later. (I’m sure we’re not setting ourselves up for an even bigger disappointment, right?).

Chipmaker Intel surged 7.5% on reports that new CEO Lip-Bu Tan is considering major changes to its AI and manufacturing strategy. Investors, desperate for signs that Intel can compete in the AI arms race, welcomed the shake-up (about time huh?).

On the other hand, fashion retailer Guess skyrocketed 27% after WHP Global made a buyout offer. It’s a reminder that, even in market correction territory, private equity firms still have cash to throw away (they never learn).

Everything now hinges on the Federal Reserve’s decision on Wednesday. Powell is expected to keep rates steady, but investors will be glued to his every word. If he hints at future rate cuts, expect another rally. If he stays hawkish and downplays the slowdown? We’re cooked.

Again, it’s all up to you Jerome. Please don’t disappoint us.

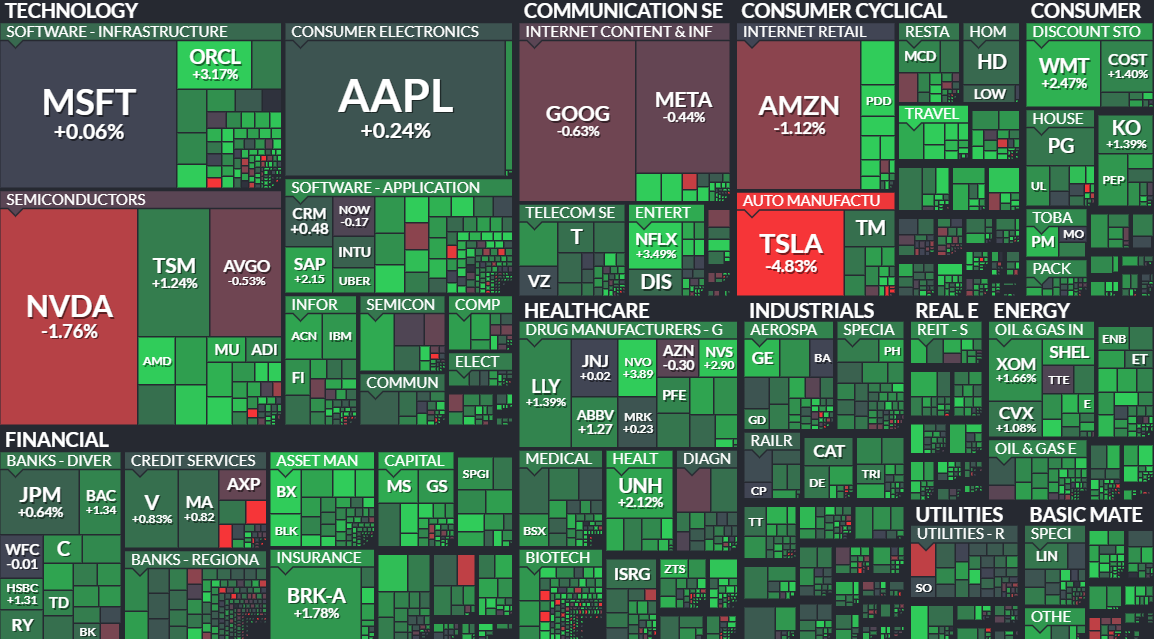

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.