Bond Market Checks Into a Psychiatric Facility as Trump Preps Hassett to Take JPow’s Throne

“I am never going to financially recover from this.” -Every bond trader after hearing Kevin Hassett’s a lock to be Jerome’s successor

First, bond markets had to survive 2022… the year Liz Truss took the UK gilt market, shoved it in a blender, and hit “puree this sh*t.” And now? Now we’re staring down the barrel of a potential Kevin Hassett Fed chairmanship… which some traders are describing as “Powell, but if Powell woke up every morning to Trump yelling ‘Cut faster!’ as his iPhone alarm.”

(Source: The Economic Times)

According to a wave of Treasury back-channel calls, the department has been quietly polling Wall Street about who should replace Powell in 2026… and, shocker, the mood is down bad.

The moment Hassett’s name entered the chat, bond investors reacted the same way I do when I get a letter from the IRS: immediate panic, followed by a quick Google of “how screwed am I really?”

(Source: New York Times)

Hassett (Trump’s economic ride-or-die and the guy who helped engineer his whole tax-cut plan) has suddenly shot to the front of the Fed shortlist. Trump said the quiet part out loud and everyone heard it. And the market panic isn’t imaginary.

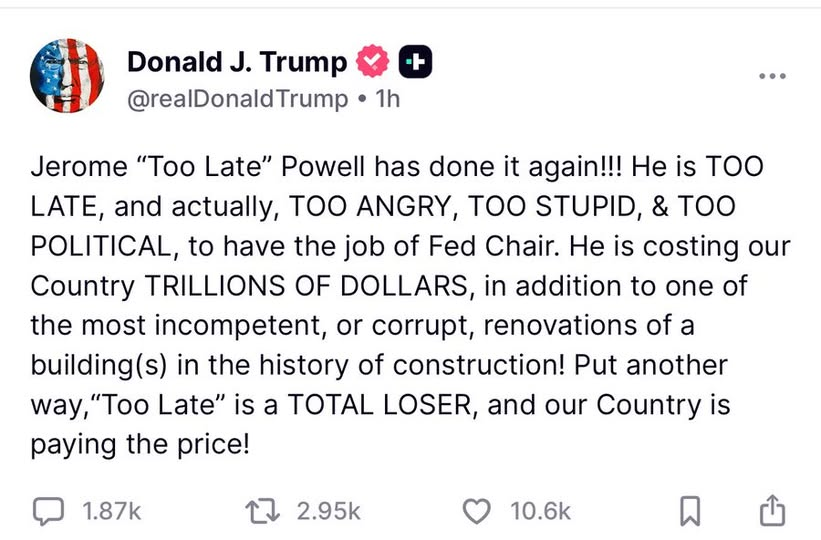

Traders know Trump’s been begging the Fed to hit rate cuts every second of the day, roasting Powell as a “stubborn mule” for taking a measured approach instead of going full “hold my beer” on monetary policy. Which is why investors are now imagining a Hassett Fed that cut rates anytime Trump fires off an encouraging emoji from the golf course.

(Source: Truth Social)

Treasury tried to calm everyone down by claiming the differences between candidates were “extremely narrow,” which is hilarious, because everyone in the building knows Hassett is the guy. And the concerns aren’t some neurotic Wall Street superstition.

If Hassett starts trimming rates with inflation still stuck at 2.7%, the long end could snap in half… markets interpret that as the Fed tapping out of the inflation fight, and yields blow out when credibility gets questioned. As one bond manager whispered, “Loose policy plus rising inflation is the part of the horror movie where you’re yelling ‘Don’t go in there!’ but the idiot goes in anyway.”

And even if Hassett looks good on a resume, investors aren’t convinced he can unify a Fed board that can’t even agree on lunch, let alone rates. His meeting with the Treasury Borrowing Advisory Committee didn’t help… rather than dive into liquidity, issuance, or term premiums, he veered off into Mexican cartel policy. Which was a strange choice, especially in a room where “cartel” only means one thing… and it pumps crude, not fentanyl.

To be fair, people who’ve worked with Hassett say he’s smart, polished, and confident. The problem is figuring out which version shows up… the serious economist with actual chops, or the Trump-era policy guy who treats CPI like a loose guideline.

As one asset manager put it, “Markets see him as a Trump loyalist, and that alone chips away at the Fed’s independence.” Translation: Trump might as well wheel his desk straight into the newly renovated Fed Headquarters (courtesy of JPow).

Powell is done in 2026, but Trump wants to announce his replacement “early next year,” which is plenty of time for the 10-year yield to have a full mental breakdown.

If the Fed turns into a runaway policy machine responding to political pressure instead of the actual data, investors aren’t going to shrug it off. That’s how you get a real bond-market mess… and not the British kind you laugh at from afar.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.