Bath & Body Gets Yeeted Into the Abyss After Earnings Point to Absolute Irrelevance…

“I ended up switching to Suave so I can afford ground beef” - everyone of BBWI’s customers, probably…

There’s a special kind of silence that hits a retail earnings call when everyone realizes the “turnaround plan” is basically a mood board. Bath & Body Works walked straight into that silence yesterday, clotheslined itself on the revenue line, and then pretended it was all part of the transformation journey.

(Source: Giphy)

Share’s were basically bodybagged on the spot… diving -25% to a new 52 week low, half the company’s value gone this year… all because the quarter landed with the energy of a mall food court at 10 a.m. EPS came in at $0.35 (Street wanted $0.39), revenue missed at $1.59B (Street wanted $1.63B), and full-year guidance basically said, “This is worse than we thought."

(Source: CNBC)

But then came the plan. The “plan”... a.k.a., the “Consumer First Formula”. CEO Dan Heaf rolled it out like he was revealing a new skincare line instead of explaining why the business keeps face-planting. $250M in cost cuts by 2027. Refocus on “core” products. Modern packaging. Social buzz. Influencers. “Younger consumers.” The kind of bullet points you write when your board asks for urgency and you hand them a friggin’ TikTok account.

As for the exit list… we have haircare, men’s grooming, anything that made them look like they were trying too hard… which was probably the only honest part. To their credit, they tried… and tried everything. And yet, they delivered nothing only to be “reorienting” back to soaps, lotions, and seasonal scents. Translation: The problem is the consumer changed and BBWI… didn’t. Everyone else evolved with ingredient trends, efficacy demands, cleaner branding, and actual product stories. Meanwhile, BBWI stood perfectly still and wondered why teenagers don’t want to smell like 2011 anymore.

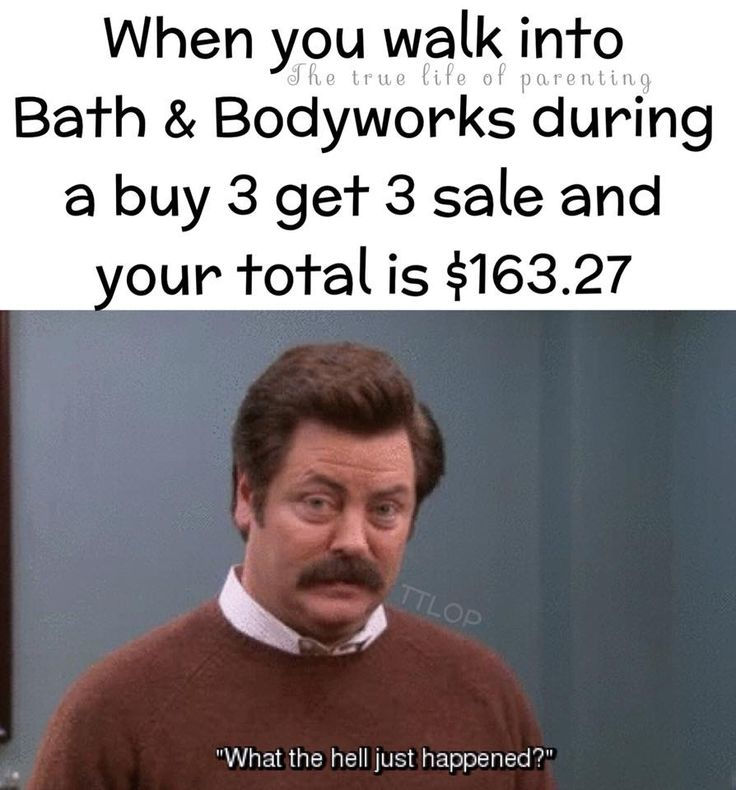

(Source: Pinterest)

Which brings me to the main crux of the earnings call: You can always tell when a retailer is out of ideas because they suddenly remember influencers exist. Heaf basically said they’re going to let TikTok decide what the company is now. In other words, they’re handing their identity to a 19-year-old with a ring light and praying she cares enough to unbox your hand soap. With that said, the digital “revamp” is coming soon… new app, new website, lower free-shipping threshold by 2026. Which is great. Truly. But also: this is 2025. These are just the bare minimum things required to exist.

Not to mention that consumers are collectively clenched and tariffs are kneecapping margins. But unfortunately, that’s the environment that everyone is operating in. And apparently, BBWI just doesn’t have the brand oxygen tank to walk into a tougher landscape and come out breathing. Which is why now, the stock is being guillotined, and Wall Street is staring at a business with declining comps, lowered guidance, and a management team whose big vision is basically:

“Let’s stop doing the things we shouldn’t have done in the first place.”

(Source: Giphy)

Of course, things can change for the better… but at this point, it’s a retail autopsy happening in real time. Meaning, keep your eyes on $BBWI and place your bets accordingly. Until next time, friends…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.