Banks Eat Pavement After Worst Jobs Print Since 2020… Altman Cheats on Jensen

Investors: “Strong jobs report to keep the rally alive, please.”

Friday’s Market: “Best I can do is 22,000 jobs (less than a third of estimates) and the first negative print since 2020.”

Today’s market felt like last night’s Cowboys-Eagles game. Dallas came out hot, Dak was dealing, everything looked smooth… and then CeeDee Lamb suddenly forgot how hands work.. Same deal on Wall Street: S&P, Nasdaq, and Dow all ripped to intraday highs… until the jobs report fumbled at the goal line. By the close, the S&P slipped 0.5%, the Dow dropped 0.5% (down 228 points), and the Nasdaq eased 0.2%. That early “we dem boys” swagger got clipped fast and turned into full Belichick mode: “onto Cincinnati.” Except in this case, it’s “onto Powell’s rate cut” and “onto next week’s inflation data.”

If you’re wondering how bad it was… based on the numbers, you’d think Indeed, LinkedIn, and every job board on Earth all crashed at once. The economy basically forgot how to hire. Just 22,000 jobs showed up in August… economists were looking for 75k, which wasn’t even a high bar. Unemployment ticked up to 4.3%. And then the BLS quietly dropped a patch note that turned June negative… the first monthly job loss since COVID. Right now, the labor market is running on fumes.

But cue the Hans Zimmer inspirational music… because the worse the jobs, the better the odds Jerome Powell pulls out the money printer and goes to town. A rate cut this month isn’t just likely… it might as well be a done deal. Traders are even whispering about a fat 50 bps chop. Meanwhile, the 10-year yield slid to 4.07%, its lowest since April, like bonds just exhaled after holding their breath all summer.

Over in “stockland,” JPMorgan and Wells Fargo tanked because slowing economy = bad for lending. Boeing and GE Aerospace caught strays, too. Broadcom was the one actually carrying the market, blasting up 9% after earnings and a rumored $10B AI order (wink wink, probably… definitely OpenAI). Nvidia, in response, lost 3% because investors got scared competition is heating up.

Down in Austin (where the motto is “Keep Austin Weird”) Elon clearly took that personally. Tesla’s board is dangling a literal $1 trillion payday if he can pump the company’s value to $8.5 trillion and unleash a million robotaxis. I honestly don’t have a problem with it considering that’s asking him to stitch together Apple, Microsoft, and Nvidia into one mega-corp. The stock popped early, then cooled… after investors remembered Tesla is still getting boatraced by Waymo in the robotaxi department.

Meanwhile, Kenvue jumped off a cliff 11% after RFK Jr. allegedly wants to drop a Tylenol-causes-autism report.

Airlines somehow pulled off a green day on an otherwise red tape Friday. American Airlines jumped 2.6%, Delta and JetBlue each climbed 1.4%, United added 1.2%, and even Southwest managed a 0.6% bump… all after the Trump admin blew up Biden’s passenger-comp rule.

Oh and let’s not forget… gold ripped to record highs at $3,650/oz, up nearly 6% on the week, because when the economy coughs even once, and Bitcoin feels like it’s due for a 20% dump, investors get the appetite for more gold nuggies.

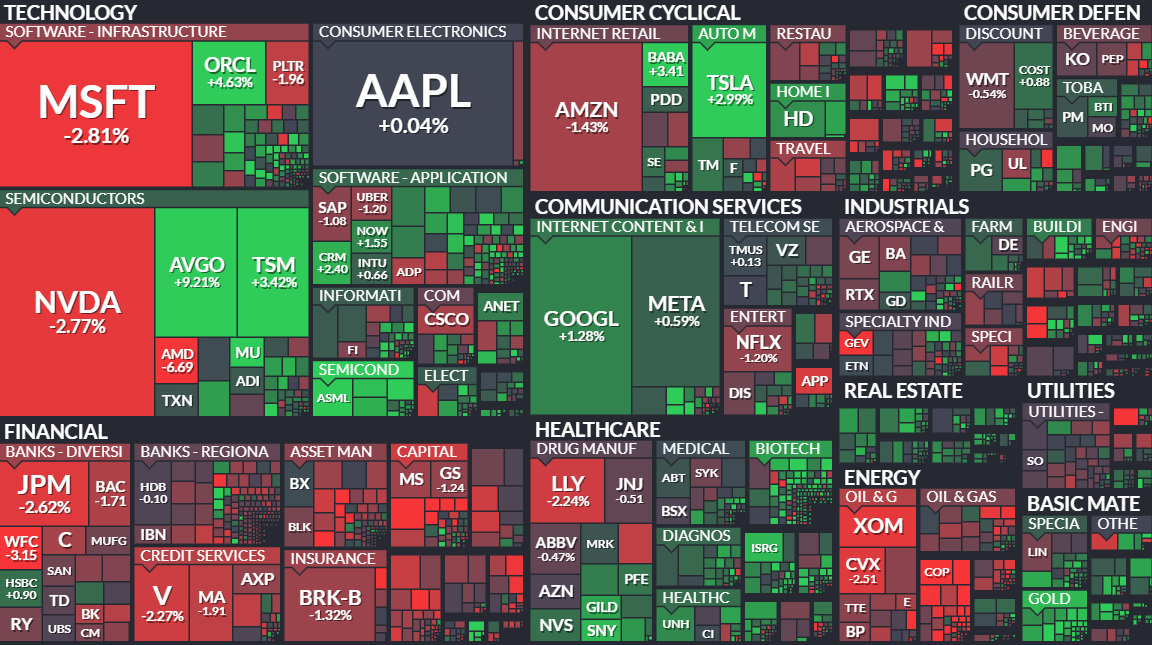

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

At the time of publishing this article, Stocks.News holds positions in GE, Tesla, Apple, Microsoft, and United as mentioned in the article.